With São Tomé and Príncipe, Starlink has now launched in 8 African countries in 2025

SpaceX satellite company Starlink has today launched its operation in São Tomé and Príncipe. This is the 8th African country it will launch in 2025, and the 25th African country to welcome Starlink’s service.

In a disclosure made on its X (formerly Twitter) account on Thursday, the Elon Musk-owned company announced its entry into the country. “Starlink’s high-speed, low-latency internet is now available in São Tomé and Príncipe!” it said.

For Sao Tome and Principe, Starlink’s high-speed internet availability signals a significant alternative when faced with internet disruption during stormy seasons.

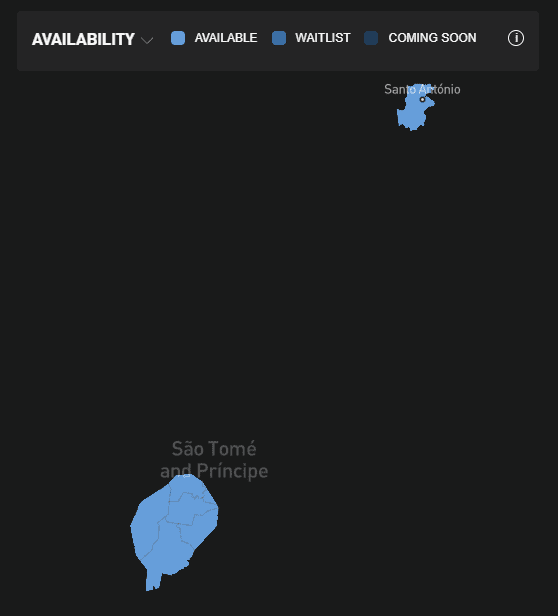

Live location signaling the satellite internet company’s presence in São Tomé and Príncipe

Live location signaling the satellite internet company’s presence in São Tomé and Príncipe

In the small island nation off Central Africa’s coast, Starlink will be offering two hardware options in São Tomé and Príncipe. The Standard Kit costs $257.3 (STN 5,500) while the Mini Kit costs $206 (STN 4,400).

Also, the monthly subscription plans come in two tiers. The Residential plan runs $79.5 (STN 1,700) per month, while the Residential Lite plan costs $60.8 (STN 1,300) per month.

São Tomé and Príncipe’s geographic isolation has historically limited investment in internet infrastructure. With a population of over 230,000 people, the two-island nation has relied on submarine cable connections and limited terrestrial networks. It’s entry provides an alternative to existing providers, though the upfront hardware cost represents a significant barrier.

For Starlink, its service is likely to find its primary customer base among businesses, government offices, and higher-income households in the country. The Elon-Musk company will look to increase the country’s internet penetration rate above the current 61.5%.

Sao Tome and Principe

Sao Tome and Principe

Also Read: Starlink rallies public support in Namibia for regulatory shift to make way for launch.

Starlink’s footprints in Africa

Starlink activating its service in São Tomé and Príncipe has now extended its African footprint to 25 countries. In 2025 alone, the company has now launched in 8 countries, including Chad, Somalia, Lesotho, Democratic Republic of Congo, Congo and Niger.

In addition, the satellite company recently received a boost towards preparation for its launch in Namibia. Firstly, the Communications Regulatory Authority of Namibia (CRAN) has started processing its regulatory approval and published Starlink’s license applications in the government’s Official Gazette on Nov. 28 and invited public comments for two weeks.

Secondly, the regulator is considering amending the local law that requires domestic telecoms companies to have 51% ownership. The relaxation of the law will boost Starlink’s launch in the country, paving the way for its operations in Namibia.

Starlink’s entry into African countries has seen interest from citizens of other countries due to its high-speed internet through a network of Low Earth Orbit (LEO) satellites. However, it is still facing regulatory challenges in some African countries.

In South Africa, the company is still caught in the middle of meeting the 30% requirement for local telecom licensees to be in the hands of historically disadvantaged groups.

While the local laws have been a long-standing rule in South Africa, several foreign companies are finding it hard to comply. They prefer an equity equivalent that provides an alternative, such as making social investment in other areas, such as skills and infrastructure development.

In defence of an alternative to the local law, SpaceX has affirmed that it would provide 5,000 rural schools with fully funded kits and services, with necessary support. For now, the wait for launch in South Africa is still on.

You May Also Like

Crypto execs met with US lawmakers to discuss Bitcoin reserve, market structure bills

Lawmakers in the US House of Representatives and Senate met with cryptocurrency industry leaders in three separate roundtable events this week. Members of the US Congress met with key figures in the cryptocurrency industry to discuss issues and potential laws related to the establishment of a strategic Bitcoin reserve and a market structure.On Tuesday, a group of lawmakers that included Alaska Representative Nick Begich and Ohio Senator Bernie Moreno met with Strategy co-founder Michael Saylor and others in a roundtable event regarding the BITCOIN Act, a bill to establish a strategic Bitcoin (BTC) reserve. The discussion was hosted by the advocacy organization Digital Chamber and its affiliates, the Digital Power Network and Bitcoin Treasury Council.“Legislators and the executives at yesterday’s roundtable agree, there is a need [for] a Strategic Bitcoin Reserve law to ensure its longevity for America’s financial future,” Hailey Miller, director of government affairs and public policy at Digital Power Network, told Cointelegraph. “Most attendees are looking for next steps, which may mean including the SBR within the broader policy frameworks already advancing.“Read more

Ethereum Price Prediction: ETH Targets $10,000 In 2026 But Layer Brett Could Reach $1 From $0.0058