Bitcoin Price Skyrockets to $94,000 as Banks Start to Embrace Bitcoin

Bitcoin Magazine

Bitcoin Price Skyrockets to $94,000 as Banks Start to Embrace Bitcoin

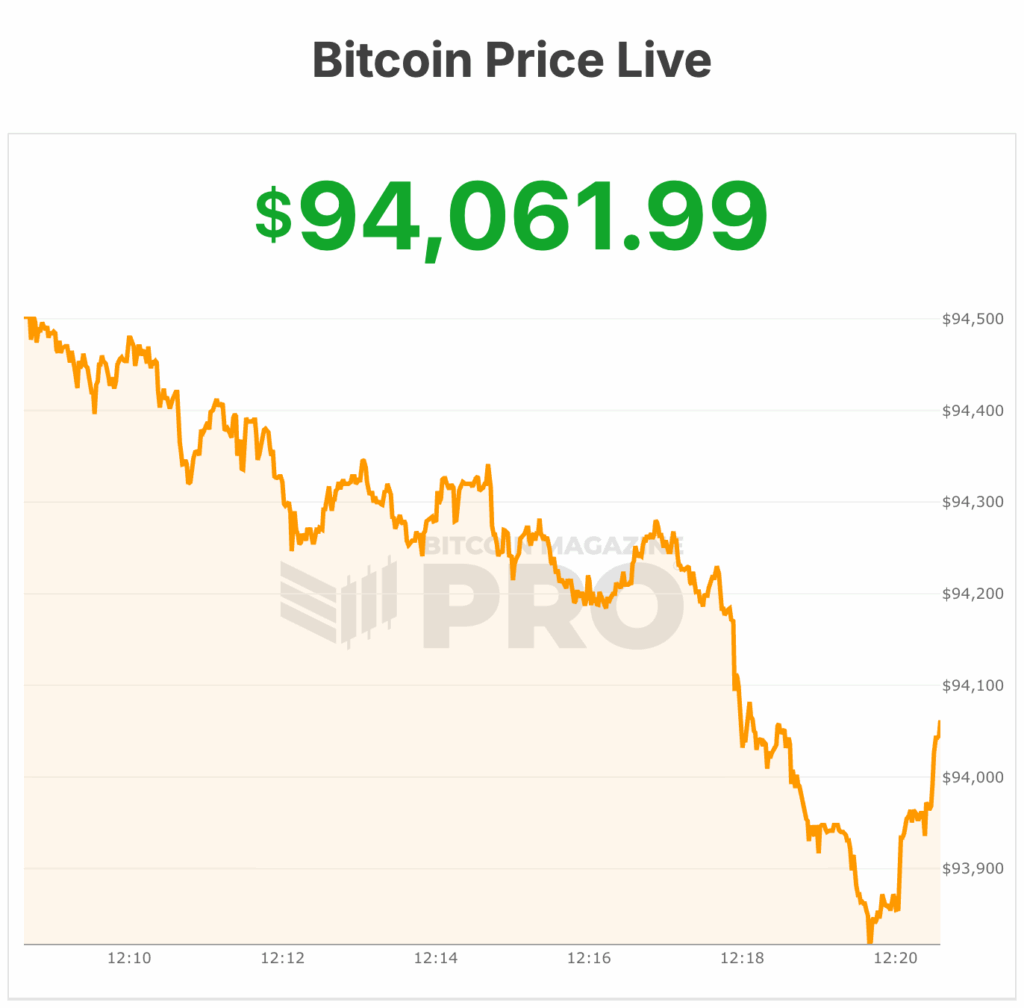

The bitcoin price is currently pumping and hit highs of $94,640 today, climbing over 4% in the last 24 hours. Bitcoin’s 24-hour trading volume reached $46 billion. It stands at its seven-day high.

The total circulating supply of Bitcoin is 19,959,806 BTC, with a maximum supply of 21 million. Today’s market capitalization is roughly $1.86 trillion, reflecting the 4% daily gain.

The broader bitcoin space is experiencing some momentum. The Bitcoin MENA conference in Abu Dhabi just wrapped up, full of bank leaders and industry thought leaders sharing their thoughts on Bitcoin’s future.

Earlier today, Jack Mallers’ Bitcoin company, Strike, and Twenty One rang the opening bell at the New York Stock Exchange. The company holds over 43,500 BTC — around $4 billion — making it the world’s third-largest publicly listed Bitcoin holder.

Majority-owned by Tether Investments and Bitfinex, with SoftBank as a significant minority investor, the company blends a Bitcoin treasury strategy with operational Bitcoin-focused financial services under CEO Jack Mallers.

Investors are also paying close attention to macroeconomic signals. Ark Invest CEO Cathie Wood said that the Bitcoin price’s four-year cycle may shift. She suggested the market may have already seen its lows.

Neuberger CIO Shannon Saccocia also noted that expected Federal Reserve rate cuts and gains in AI-driven productivity could lift equities and other risk assets. Stocks often perform well when the economy avoids recession and the Fed is easing.

Bitcoin price rally

Bitcoin price’s recent rally comes amid growing adoption and institutional interest. Large players are integrating Bitcoin into payments and financial products.

For example, earlier today, PNC Bank became the first major U.S. bank to offer direct spot bitcoin trading to eligible Private Bank clients through its digital platform, using Coinbase’s Crypto-as-a-Service infrastructure.

The service allows qualified clients to buy, hold, and sell bitcoin without relying on external cryptocurrency exchanges.

Coinbase provides the trading, custody, and settlement infrastructure, while PNC retains the direct client relationship and regulatory oversight.

The launch follows a strategic partnership announced in July and reflects a growing trend among U.S. banks to integrate bitcoin into wealth management services.

Also last week, the Bank of America urged its wealth management clients to allocate 1% to 4% of their portfolios to digital assets, signaling a major shift in its approach to Bitcoin exposure. The move allowed over 15,000 advisers across Merrill, Bank of America Private Bank, and Merrill Edge to proactively recommend crypto to clients.

At the time of writing, the bitcoin price is $94, 061.

This post Bitcoin Price Skyrockets to $94,000 as Banks Start to Embrace Bitcoin first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

Why Scalable Blockchain Infrastructure Is Critical for India’s Web3 Revolution?