MBNA offers a fantastic balance transfer credit card since you won’t pay interest on the transferred balance for 12 months. If you’re looking for cash back or strong insurance coverage, however, there are much better card options available.

MBNA True Line Mastercard Review

The MBNA True Line Mastercard is well-known for being a balance transfer credit card because

It offers one of the best promotions in the country. In this review, we’ll look at the card’s features so you can get a good idea of whether or not you want this card in your wallet.

Who is the MBNA True Line Mastercard best for?

If you’re planning to transfer your credit card balance and pay down debt, the MBNA True Line Mastercard has the best promotion and terms of any balance transfer credit card.

MBNA True Line Mastercard: The basics

MBNA True Line Mastercard

Annual fee: $0

Balance transfer offer: Receive a 0% interest rate for 12 months on balance transfers completed within 90 days. (Offer not available for residents of Quebec.)

Card details

| Interest rates | 12.99% on purchases, 24.99% on cash advances, 17.99% on balance transfers |

| Income required | None specified |

| Credit score | 660 or higher |

The MBNA True Line Mastercard is most well-known for its balance transfer promotion, but before you apply, take a look at the card’s basics to see if it might be right for you.

| Earn rates | No rewards |

|---|---|

| Insurance included | 90-day purchase protection 1-year extended warranty |

| Special perks and features | No annual fee 0% promotional balance transfer for 12 months Low interest rate on purchases Can add up to nine authorized users for no additional fee MBNA Payment Plan allows you to pay in installments Rental car discounts |

| Fees | Foreign transaction fee: 2.5% |

| Minimum credit limit | Any amount |

| Supplementary card cost | $0 |

Pros and cons of the MBNA True Line Mastercard

This Mastercard isn’t your only balance transfer credit card option. Weigh the card’s benefits against its drawbacks to help you narrow your choices.

Pros:

- Long promotional transfer period: Many balance transfer cards limit the length of the balance transfer promotion, but the MBNA True Line Mastercard gives you a full year at 0% interest.

- Low interest rate on purchases: With an interest rate of 12.99%, the MBNA True Line Mastercard’s rate is considerably lower than the national average.

- No income requirements: While you do have to meet credit score requirements, this Mastercard doesn’t have personal or household income requirements, making it easier to qualify for.

- No annual fee: Put your money towards paying down your credit card balance instead of paying for the privilege of using the credit card.

Cons:

- Balance transfer fee: Although you pay 0% interest on balance transfers, you will be charged a 3% fee on the total transfer amount.

- No rewards: If you decide to keep using this card once you pay the transferred balance, be aware that your purchases won’t earn you rewards like cash back.

- Limited insurance included: This Mastercard doesn’t include any travel, rental car, or mobile device insurance coverage. You’ll only get the standard purchase protection and extended warranty when you use your card to make a purchase.

MBNA True Line Mastercard perks and benefits

We won’t sugarcoat it: the MBNA True Line Mastercard is primarily known for its balance transfer opportunities, not its (limited) perks and benefits.

MBNA Payment Plan

If you’re making a $100+ purchase with your True Line Mastercard but don’t want to pay for it all at once, the MBNA Payment Plan allows you to split it into installments. This way, you can effectively budget for a modest monthly payment. Here are the three payment options:

- 6 months with a 4% fee and 0% interest rate

- 12 months with a 6% fee and 0% interest rate

- 18 months with an 8% fee and 0% interest rate

Rental car discounts

Pay for an Avis or Budget rental car in Canada or the U.S. using your MBNA Mastercard and you’ll save a minimum of 10% off the base rate. If you rent a car internationally through Avis or Budget, you’ll save at least 5% off the base rate.

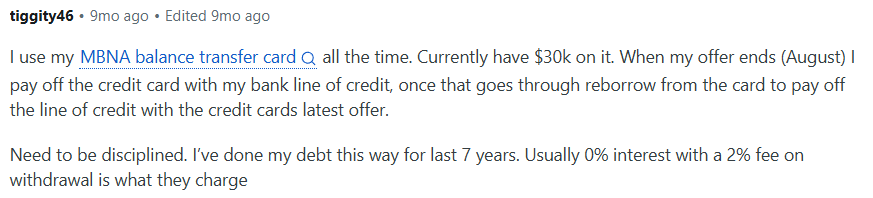

What cardholders think

It’s always helpful to see what real cardholders have to say, so we turned to Reddit for insight.

Just note that the actual transfer fee is 3%.

We also like to check the financial strength of a card issuer, using third-party reviews. Here’s what we found:

- J.D. Power: MBNA’s customer satisfaction score of 531, second from the bottom, suggests that customers may receive mixed support and service.

- Better Business Bureau: 1.0/5 based on 20 customer reviews with the BBB.

- Trustpilot: 1.3/5 based on 170 customer reviews, primarily regarding problems with payment processing and poor communication when it comes to customer service.

We’ll leave you with this important reminder from one cardholder: always make your minimum payment or your promotional period will end.

Yes, TD Bank acquired MBNA in 2011, which effectively doubled TD’s number of active credit card accounts.

MBNA doesn’t specify what credit score you need, but your odds of approval are better with a score that’s 660 or higher.

Read more about credit cards:

- The best no-fee credit cards in Canada for 2025

- The best credit cards in Canada for 2025

- Fee-based credit cards come with perks—but they aren’t for everyone

- Applying for a credit card: What you need to know

The post MBNA True Line Mastercard Review appeared first on MoneySense.

You May Also Like

Crypto Market Cap Edges Up 2% as Bitcoin Approaches $118K After Fed Rate Trim

Vitalik Buterin Reveals Ethereum’s Long-Term Focus on Quantum Resistance