eToro Reports Strong Q1 on Back of Increased Trading Activity, But Shares Plunge by 12%

eToro reported a net income of $60 million for Q1 2025 on 10 June 2025, posting robust financial results due to strong user engagement and a significant uptick in trading activity across its global markets. eToro’s net contribution for Q1 increased by 8%, reaching $217 million.

Meron Shani, eToro CFO said, “Our results show strong business performance for Q1 with an increase in net contribution driven by increased trading activity and our continued focus on sustainable, profitable growth.”

“The retail investor of 2025 is informed and connected, and we’re encouraged to see their trading behavior enabling them to benefit from market opportunities,” said Yoni Assia, CEO and Co-founder of eToro. “As a global community that empowers retail investors, we are well-positioned to drive sustainable growth and profitability over time, creating further value for our shareholders.”

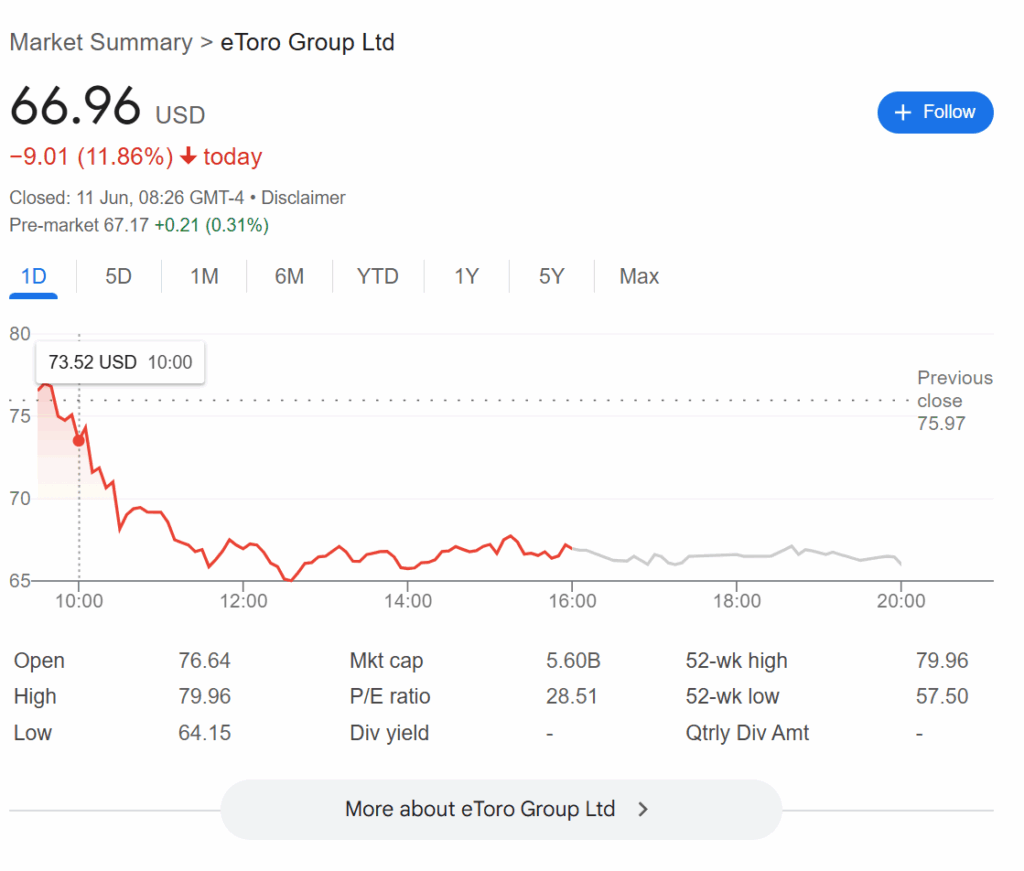

eToro shares fall nearly 12% Yesterday

However, eToro shares fall nearly 12% after debut earnings show rising costs and compressed EBIDTA margins. Interestingly, the company’s shares surged to a new all-time high on 10 June 2025. But the trend reversed quickly as the stock hit an intraday low. After opening at $79.96, the day closed at $66.96 on Tuesday.

Source: eToro group

eToro Launched Futures In Europe, Options In UK In Q1

The company said that it continues to expand and develop the range of assets and tools users need to trade the global markets. In the first quarter, eToro launched futures in Europe and options in the UK. In Q1, eToro was granted a MiCA permit by CySec, which enables EU wide services for the company.

Furthermore, eToro added stocks from the Abu Dhabi and Hong Kong stock exchanges and now offers users the ability to invest in companies listed on more than 20 of the world’s leading exchanges.

With the addition of 40 more tokens, eToro offers trading in over 130 crypto assets. The Company also extended trading hours by offering a number of stocks and ETFs for 24/5 trading.

eToro’s Funded accounts increased 14% year on year to 3.58 million compared to 3.13 million in the first quarter of 2024. The company said that as of 31 May 2025 it had 3.61 million funded accounts and $16.9 billion in Assets under Administration.

eToro reported robust financial results due to strong user engagement and a significant uptick in trading activity across its global markets.

The company’s shares surged to a new all-time high on 10 June 2025. But the trend reversed quickly as the stock hit an intraday low.

The post eToro Reports Strong Q1 on Back of Increased Trading Activity, But Shares Plunge by 12% appeared first on 99Bitcoins.

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

Solana Price Prediction from Standard Chartered