Crypto Wallets Are a $4T Opportunity, Says BlackRock CEO, as Best Wallet Token Benefits

KEY POINTS: BlackRock’s latest earnings report shows its assets under management have reached $13.46T.

BlackRock’s latest earnings report shows its assets under management have reached $13.46T. The success of BlackRock’s iShares Bitcoin Trust (IBIT), which became the fastest ETF to hit $100B in assets, proves there is strong institutional demand for crypto.

The success of BlackRock’s iShares Bitcoin Trust (IBIT), which became the fastest ETF to hit $100B in assets, proves there is strong institutional demand for crypto. The shift by major financial players like BlackRock, JPMorgan, and Morgan Stanley shows that digital assets are becoming a legitimate part of mainstream finance.

The shift by major financial players like BlackRock, JPMorgan, and Morgan Stanley shows that digital assets are becoming a legitimate part of mainstream finance.

During the earnings call, CEO Larry Fink dropped a bombshell, noting that roughly $4.1T is now held in digital wallets globally. He believes that if traditional investments like ETFs could be tokenized, basically, turned into digital assets, it would open up a new world for investors and create the next wave of opportunity for BlackRock.

Think of it like a bridge between the old-school stock market and the crypto-savvy generation.

And it’s not just talk. BlackRock’s own iShares Bitcoin Trust (IBIT) has become an absolute rocket ship. It’s now the firm’s top-earning ETF, and it hit nearly $100B in assets in under 450 days, faster than any other ETF in history.

This remarkable success demonstrates that major investors and financial institutions are eager to invest in crypto. The shift isn’t just a BlackRock thing. Major players like JPMorgan are also getting into the crypto game, which signals that digital assets are officially a legit part of mainstream finance.

With its massive size, powerful technology, and growing crypto empire, BlackRock is well-positioned to shape the future of finance, one where your digital wallet may be just as important as your bank account.

Your Crypto, Your Rules: The Power of Best Wallet

In a world of centralized exchanges and complex platforms, Best Wallet is changing the game. This isn’t just another crypto wallet; it’s your all-in-one solution for managing digital assets with unprecedented ease and security.

Best Wallet is a non-custodial wallet, which means you, and only you, control your private keys. This self-custody model provides the ultimate protection against hacks, bankruptcies, and third-party risks that have plagued the industry.

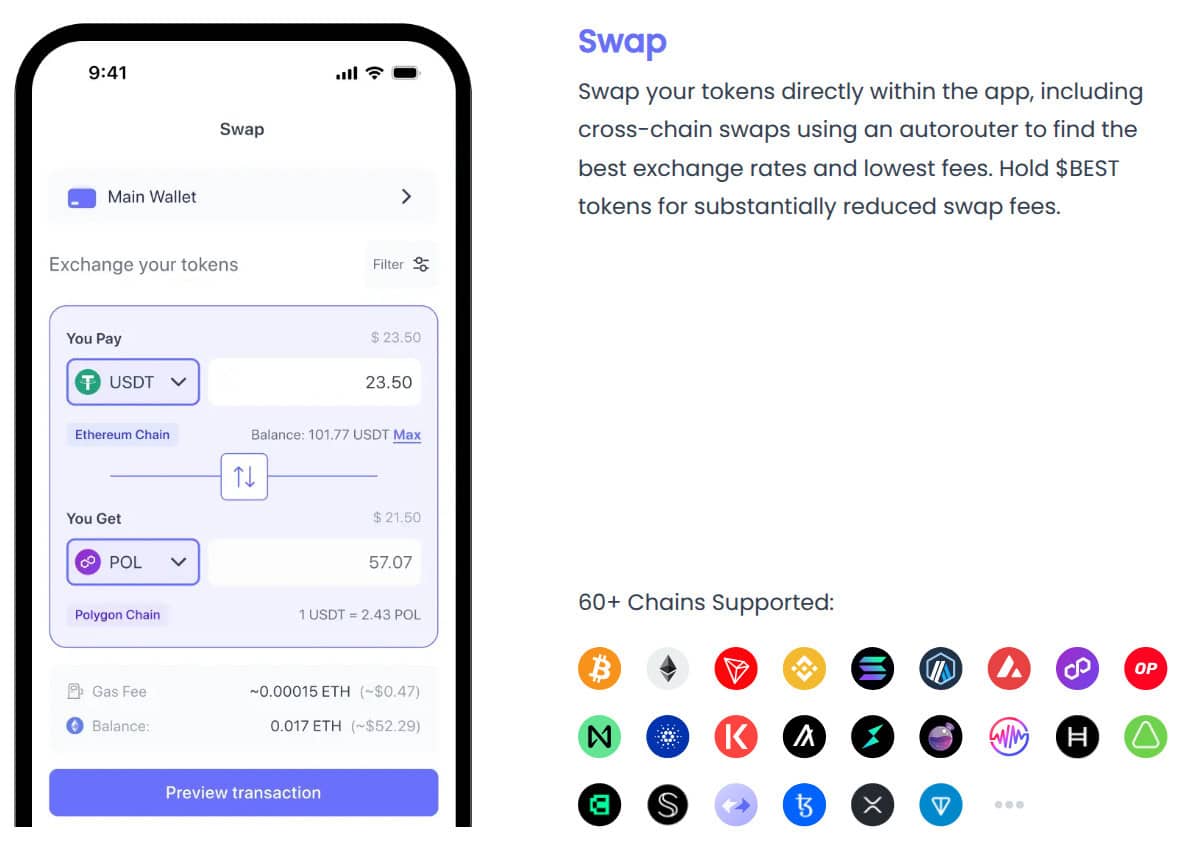

But security is just the beginning. Best Wallet is designed to be a multi-chain powerhouse, seamlessly supporting seven blockchains, including Bitcoin, Ethereum, and Solana, with plans to expand to over 60.

With its integrated DEX, you can buy, sell, and swap thousands of cryptocurrencies within the app, all while maintaining complete control of your funds.

Say goodbye to the hassle of moving assets between platforms and dealing with endless transaction fees. The platform also features a built-in staking aggregator, enabling you to earn passive income on your holdings with some of the highest yields available on the market.

With an intuitive interface that simplifies even the most advanced features, Best Wallet makes crypto management accessible to everyone, from beginners to seasoned traders. It’s time to reclaim your financial freedom.

Unlock Exclusive Rewards with the $BEST Token

Best Wallet is powered by its native token, $BEST. This is a governance token that also serves as a key unlocking a world of exclusive benefits and rewards. By holding $BEST, you gain access to a range of powerful utilities designed to give you a competitive edge.

One of the most exciting perks is early access to new token presales. The ‘Upcoming Tokens’ launchpad gives you a first look at vetted crypto projects before they hit mainstream exchanges, giving you the chance to get in on the ground floor.

Additionally, holding $BEST reduces your transaction and swap fees across the platform, a significant benefit for active traders. You’ll also receive boosted staking yields, maximizing your passive income with higher APYs, currently sitting at 80%.

The value of $BEST extends beyond the app, with the upcoming Best Card, which will enable you to spend your crypto at millions of merchants worldwide, offering cashback rewards and fee reductions.

With all these features, $BEST isn’t just a token; it’s your all-access pass to a smarter, more rewarding crypto experience.

Our crypto experts see $BEST going far, as high as $0.051903. This would yield a 101.21% ROI if you purchased at today’s price.

You May Also Like

Trump foe devises plan to starve him of what he 'craves' most

Why Bitcoin Is Struggling: 8 Factors Impacting Crypto Markets