Bitcoin ETFs See Sharp Turnover: Analysts Highlight AVAX, Cardano for 30% Upside This Week

Bitcoin explosive ETF inflows have sparked new interest across the crypto market. Analysts now rank Avalanche (AVAX), Cardano (ADA), and MAGACOIN FINANCE among the best altcoins to buy this week. With institutional money flowing in and traders regaining confidence, the spotlight is shifting fast toward undervalued projects.

Bitcoin ETF Volumes Break Records

Bitcoin exchange-traded funds (ETFs) opened the week with massive volume, recording $2.6 billion in trading during the first two hours. BlackRock led the charge, with over $2 billion in turnover, far outpacing competitors like Fidelity and Grayscale. This shows how quickly institutional demand for Bitcoin is rebounding after last week’s market crash.

Despite a weekend filled with $19 billion in liquidations and sharp drops across major tokens, Bitcoin rebounded near $115,800 by Monday morning. The fast recovery shows growing confidence from both retail and professional traders.

According to CoinShares data, Bitcoin funds attracted $2.7 billion in inflows over the week, bringing yearly totals above $30 billion. Analysts say such strong inflows often mark early signs of accumulation, where large buyers quietly build positions before new price surges.

With Bitcoin ETFs drawing billions in just hours, traders expect continued volatility — but also opportunity. Many see this as a setup week for altcoins that typically follow Bitcoin’s lead once market stability returns.

Avalanche (AVAX) Price Outlook Amid Institutional Action

Avalanche (AVAX) continues to attract attention from major market players. Its network is gaining recognition for speed and scalability, and large treasury firms are reportedly preparing to launch on its ecosystem.

Backing from firms like Dragonfly and Pantera adds credibility, while over 5 million AVAX tokens have already been burned — reducing supply and boosting long-term value perception.

AVAX is currently trading near $28, consolidating after a mild correction. Analysts expect the next breakout to push it toward the $38–$40 range if volume remains steady. Avalanche’s $10 billion in on-chain volume over the past ten days shows how active its ecosystem remains, even during broader market corrections.

Institutional desks and crypto funds continue to accumulate AVAX quietly, seeing it as one of the best altcoins to buy during recovery phases. As liquidity and network usage remain steady, many traders expect Avalanche to outperform once Bitcoin stabilizes above key price levels.

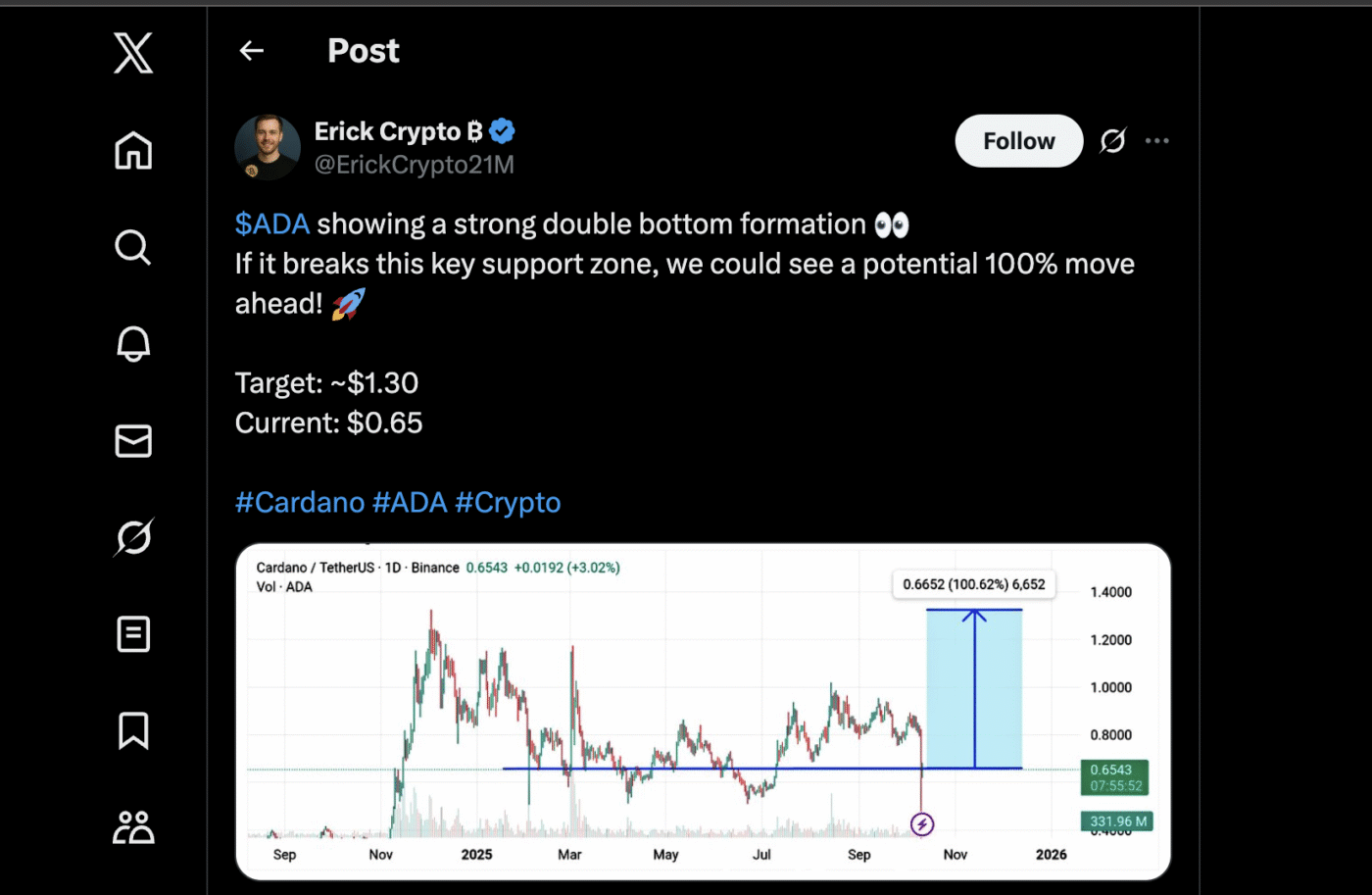

Cardano Price (ADA) Recovers with 12% Daily Gain

Cardano price has reclaimed the $0.70 level after rebounding from $0.62, posting a 12% surge that has reignited optimism among traders. The quick rebound came after one of the toughest sell-offs in recent weeks, suggesting renewed participation from both retail and institutional players.

Analysts believe ADA could climb toward $0.80–$0.85 if buying activity holds above $0.68. Historical data also shows that ADA tends to perform well following deep corrections, often leading to multi-week rallies.

Some experts even forecast a move toward $1.30 in the medium term if current levels hold. Oversold conditions, combined with a visible rebound in volume, position Cardano as one of the top altcoins to buy for short-term traders looking for a potential 30% move this week.

The return of strong demand across spot exchanges suggests that Cardano’s retracement phase might be ending, setting the stage for a new upward cycle.

MAGACOIN FINANCE: The New Altcoin on Analysts’ Radar

Amid renewed market optimism, MAGACOIN FINANCE is emerging as an institutional and analyst favorite among the best crypto to buy this week. With over 20,000 investors already taking positions and listings expected soon on both DEX and CEX platforms, traders are beginning to treat it as a serious contender alongside Bitcoin and Cardano.

Whales are accumulating, and social chatter points to growing FOMO among early participants. Analysts believe MAGACOIN FINANCE could outperform AVAX and ADA because it’s newer, undervalued, and still early in its market cycle.

Right now, early participants can get a 50% extra bonus with the code PATRIOTS100X — a limited-time offer before listings begin. The window for early access is closing fast, driving strong attention to this fast-rising altcoin.

How Traders Are Positioning

With Bitcoin ETF inflows soaring and top altcoins showing renewed energy, traders are rotating back into projects with active ecosystems and institutional interest. For those seeking early exposure, MAGACOIN FINANCE stands out as a fresh market entry with growing demand and visible FOMO among investors. To learn more or secure access before listings begin, visit the links below:

- Website: https://magacoinfinance.com

- X: https://x.com/magacoinfinance

- Telegram: https://t.me/magacoinfinance

The post Bitcoin ETFs See Sharp Turnover: Analysts Highlight AVAX, Cardano for 30% Upside This Week appeared first on Blockonomi.

You May Also Like

The Arweave network has not produced a block for over 24 hours.

HOT MOMENTS: FOMC Statement Released Following the Fed Interest Rate Decision – Here Are All the Details of the Full Text