Aave Price Prediction 2025 – What to Expect From The Upcoming V4 Protocol

Aave, one of the most influential decentralized finance (DeFi) platforms, is preparing for a major leap forward with the introduction of its V4 protocol upgrade, expected to launch in the fourth quarter of 2025.

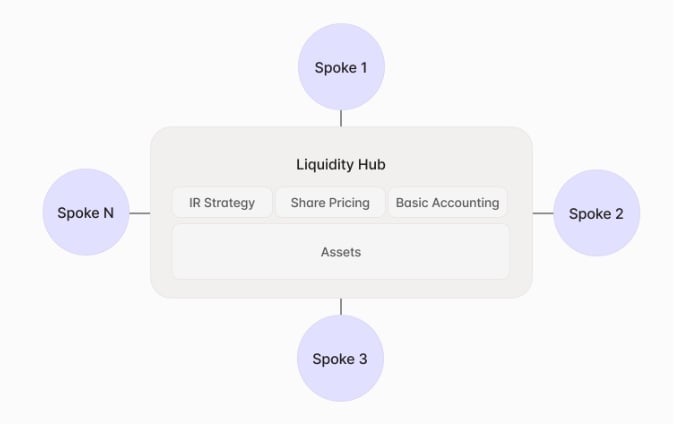

This update marks a crucial milestone in Aave’s ongoing mission to refine decentralized lending and borrowing systems. The V4 upgrade introduces a new modular “hub and spoke” architecture designed to enhance liquidity flow, risk management, and user flexibility.

Instead of the previous monolithic setup, this modular approach allows different markets, referred to as “Spokes”, to connect to a central liquidity hub, offering varied risk profiles and lending rates without isolating capital in separate siloes.

Aave V4’s “hub and spoke” system illustrated. Source – Aave

The new system also provides a unified interface, enabling users to monitor their positions across multiple market modules with improved transparency. In addition, Aave’s position manager feature will automate certain on-chain actions, streamlining the user experience.

With its expanding ecosystem and growing total value locked (TVL), Aave continues to reinforce its position as a cornerstone of the DeFi landscape, supported by partnerships like its recent collaboration with Blockdaemon to enhance institutional-grade staking and security standards.

Currently, Aave’s market cap sits near $3.9 billion, with projections suggesting further upside if DeFi adoption continues accelerating and stablecoin usage expands beyond the $15 billion mark.

Much of Aave’s future growth potential will also depend on Ethereum’s performance, as the platform is built on the ERC-20 standard. This means that a strong Ethereum rally could lift $AAVE’s valuation and its total locked value simultaneously.

With altcoin market capitalization pressing against the $1.7 trillion resistance zone and aiming toward a $2.1–$2.6 trillion target range, Aave’s V4-driven momentum could position it as one of the key beneficiaries of the next major DeFi cycle.

This article discusses Aave’s price prediction and the newly emerging crypto project Bitcoin Hyper, as highlighted by analyst and trader Jacob Crypto Bury. You can watch his full analysis in the video below or on his YouTube channel.

Aave Price Prediction

From a technical perspective, Aave’s market trajectory remains closely tied to broader altcoin momentum. After rebounding from recent liquidation events, $AAVE currently trades around the $255 level.

Historically, this range has served as a launchpad for significant upward movements. Should the market maintain this support and gain momentum, Aave could aim for its next major resistance near $388, a level that has repeatedly triggered rejections in past rallies.

A breakout above this threshold could signal a 50% price gain, especially as the V4 upgrade generates renewed investor optimism. On the other hand, potential short-term downside remains, with a safety net near $218 providing an area of interest for buyers in the event of broader market weakness.

Bitcoin Hyper Joins Aave as a Top Contender in the Next Crypto Bull Cycle

While Aave remains a top-tier DeFi asset, investors seeking diversification might also explore emerging alternatives with strong fundamentals and growth potential. Projects like Bitcoin Hyper are emerging as some of the most talked-about new crypto presales in 2025, having raised around $23.6 million.

The project is attracting massive investor attention for its mission to expand Bitcoin’s capabilities by introducing Layer-2 (L2) solutions that make transactions faster, cheaper, and more flexible for developers.

By introducing programmability similar to what’s seen on blockchains like Ethereum and Solana, Bitcoin Hyper could transform Bitcoin from a simple store of value into a foundation for decentralized applications. This upgrade represents a major shift toward scalability and innovation within the Bitcoin ecosystem.

Bitcoin Hyper integrates Solana’s Virtual Machine (SVM) technology, enabling lightning-fast performance with zero lag. The inclusion of zero-knowledge rollups (ZK-rollups) further enhances transaction efficiency and privacy, all while maintaining Bitcoin’s core security.

This blend of scalability, speed, and safety is what sets Bitcoin Hyper apart from other new projects. As attention shifts toward altcoins and new L2 ecosystems, Bitcoin Hyper could benefit from increasing capital inflows during the next crypto cycle.

By bridging the gap between Bitcoin’s proven stability and modern blockchain performance, Bitcoin Hyper positions itself as a high-potential buy alongside Aave. To take part in the $HYPER token presale, visit bitcoinhyper.com.

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

Fed forecasts only one rate cut in 2026, a more conservative outlook than expected

XRPL Validator Reveals Why He Just Vetoed New Amendment