Bitcoin Hyper Raises $1M in One Week—Could It be the Best Crypto to Buy Now?

KEY POINTS:

The market has suffered a massive downturn over the weekend, resulting in around $20B in liquidations.

The market has suffered a massive downturn over the weekend, resulting in around $20B in liquidations.

Some projects have remained unaffected, though, including the Bitcoin Hyper presale, which managed to raise $1M in a single week.

Some projects have remained unaffected, though, including the Bitcoin Hyper presale, which managed to raise $1M in a single week.

Bitcoin Hyper has already raised over $23.5M to date, making it one of the best crypto to buy now.

Bitcoin Hyper has already raised over $23.5M to date, making it one of the best crypto to buy now.

The Bitcoin Hyper ($HYPER) presale remained unscathed, however, as it continues to gain momentum this week. In fact, one of this year’s best presales raised $1M in a single week, bringing its current total to over $23.5M.

But what’s the buzz about this project, and why are investors of all sizes rushing to acquire its tokens? Let’s find out.

The Bitcoin Blockchain: Secure But Limited

Aside from being the most valuable cryptocurrency in the world, Bitcoin is also renowned for its highly robust security. The key to this is its simplified code, which keeps the network secure.

The downside here is that it limits what Bitcoin can be used for. As it is, $BTC is only good as a store of value. This means that you can’t use it for more advanced applications, such as staking.

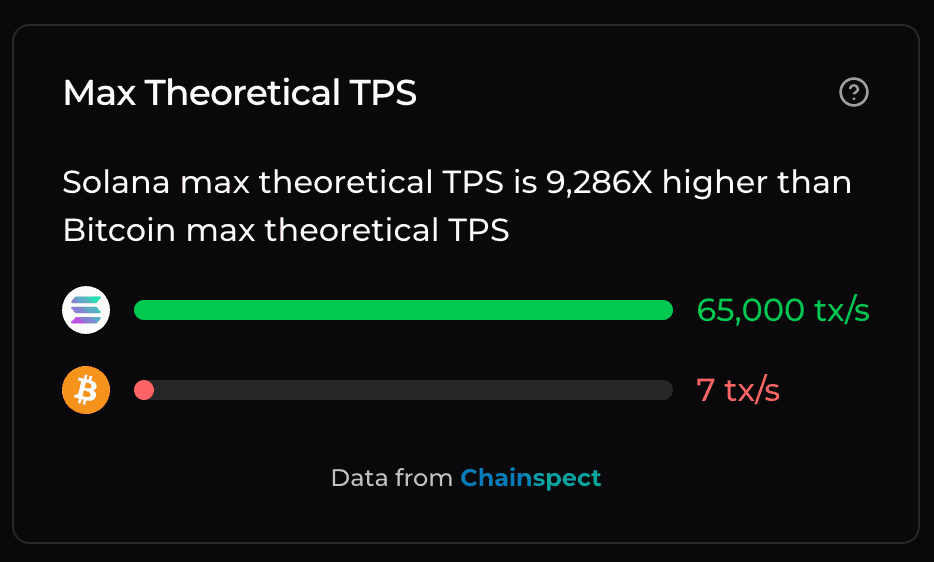

Another Achilles heel of the blockchain is its slow transaction speeds. The Bitcoin blockchain can only handle up to seven transactions per second (TPS). This causes network congestion, making transactions relatively costly.

In contrast, Solana can handle up to 65K TPS. This makes it well-suited for modern crypto applications. As an added benefit, transactions on the Solana blockchain are also considerably cheaper.

While the limited scalability, as well as the slow and costly transactions, haven’t been major roadblocks to the adoption of Bitcoin, improvements can still be made.

Bitcoin Hyper: Taking the Bitcoin Ecosystem to the Next Level

To compensate for Bitcoin’s limitations, various projects have emerged to enhance the base blockchain.

This is where Bitcoin Hyper ($HYPER) comes in.

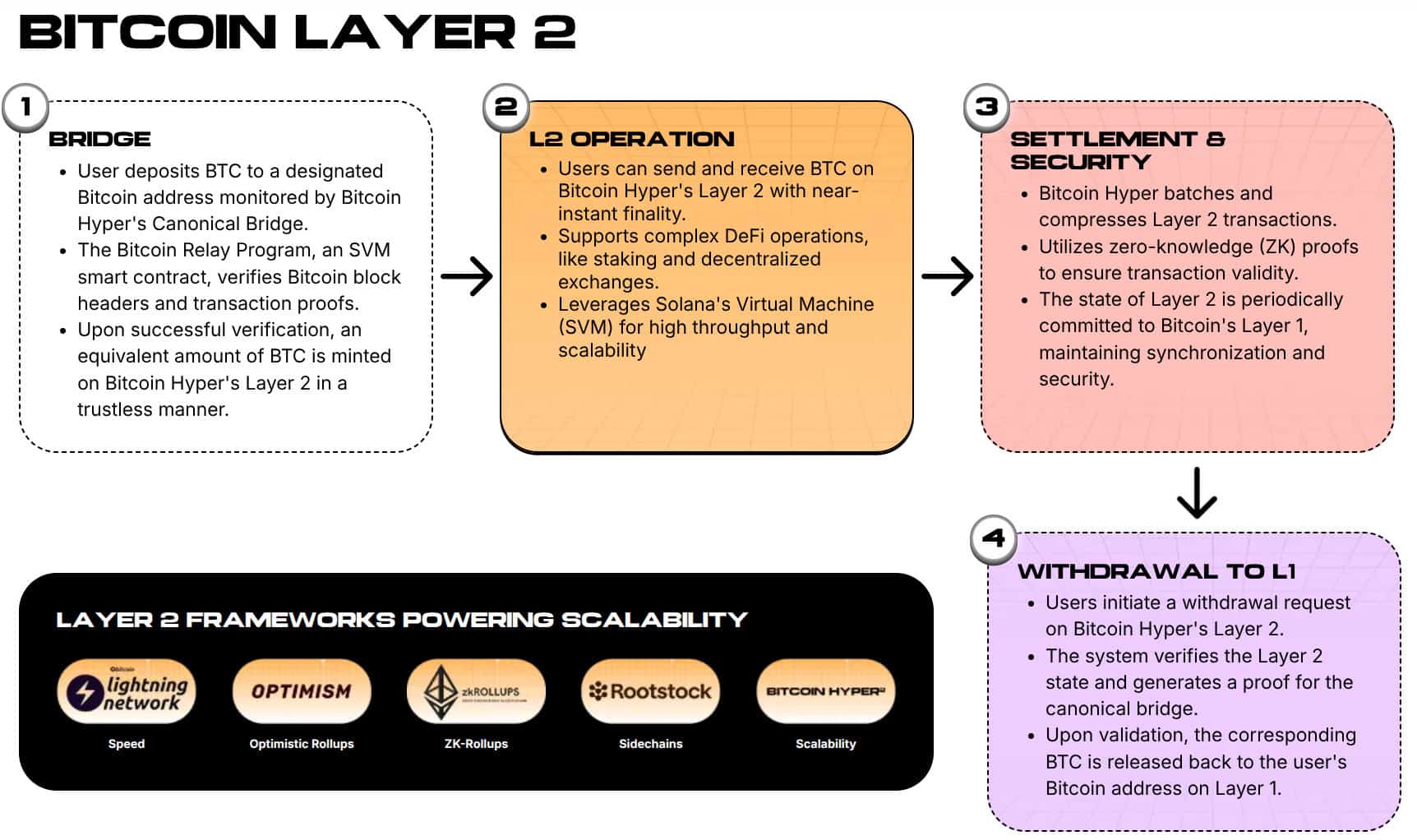

The project aims to develop a Layer 2 network that will run on a Solana Virtual Machine. By doing so, you’ll be able to enjoy Solana-level speeds and low transaction costs within the Bitcoin Hyper ecosystem.

Aside from that, the L2 will feature a canonical bridge. Having this will allow you to send your $BTC from the base blockchain to the L2, enabling you to use your Bitcoin for a wide variety of applications, such as staking, trading, and interacting with dApps.

Here’s a brief look at how everything will work upon launch:

$HYPER: Powering the Bitcoin Hyper Network

When the L2 launches, Bitcoin Hyper’s native $HYPER token will be your ticket to everything the network has to offer. For one, you’ll be able to use it to pay for gas fees. Aside from that, holding $HYPER will give you governance rights and access to exclusive features.

For now, you can buy $HYPER tokens at the official Bitcoin Hyper presale page. To get started, connect your crypto wallet to the presale widget and pay with your credit/debit card or crypto.

Get step-by-step instructions on how to get $HYPER tokens in our complete guide on how to buy Bitcoin Hyper.

Get step-by-step instructions on how to get $HYPER tokens in our complete guide on how to buy Bitcoin Hyper.

Alternatively, you can stake your tokens upon purchase and enjoy 50% APY in staking rewards. Note, however, that this can still change as more investors lock their tokens in the staking pool.

Currently priced at $0.013115, $HYPER tokens won’t be this cheap for long. That’s because another price increase is scheduled in the next 24 hours, so the sooner you buy tokens, the better.

Looking to HODL $HYPER? The tokens have the potential to reach a high of $0.03 each this year, according to our Bitcoin Hyper price prediction.

Looking to HODL $HYPER? The tokens have the potential to reach a high of $0.03 each this year, according to our Bitcoin Hyper price prediction.

The project has recently captured the attention of many investors, especially those seeking to acquire $HYPER at a discounted price. This has resulted in $1 million in sales in a single week, bringing the total amount raised to over $23.5M and counting.

But time is running out for this year’s hottest token presales, so don’t delay.

Join the Bitcoin Hyper presale today.

You May Also Like

The Channel Factories We’ve Been Waiting For

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets