Trader Loses $21M on Hyperliquid – Why Best Wallet Token ($BEST) Is the Safer Future of DeFi

Key Points:

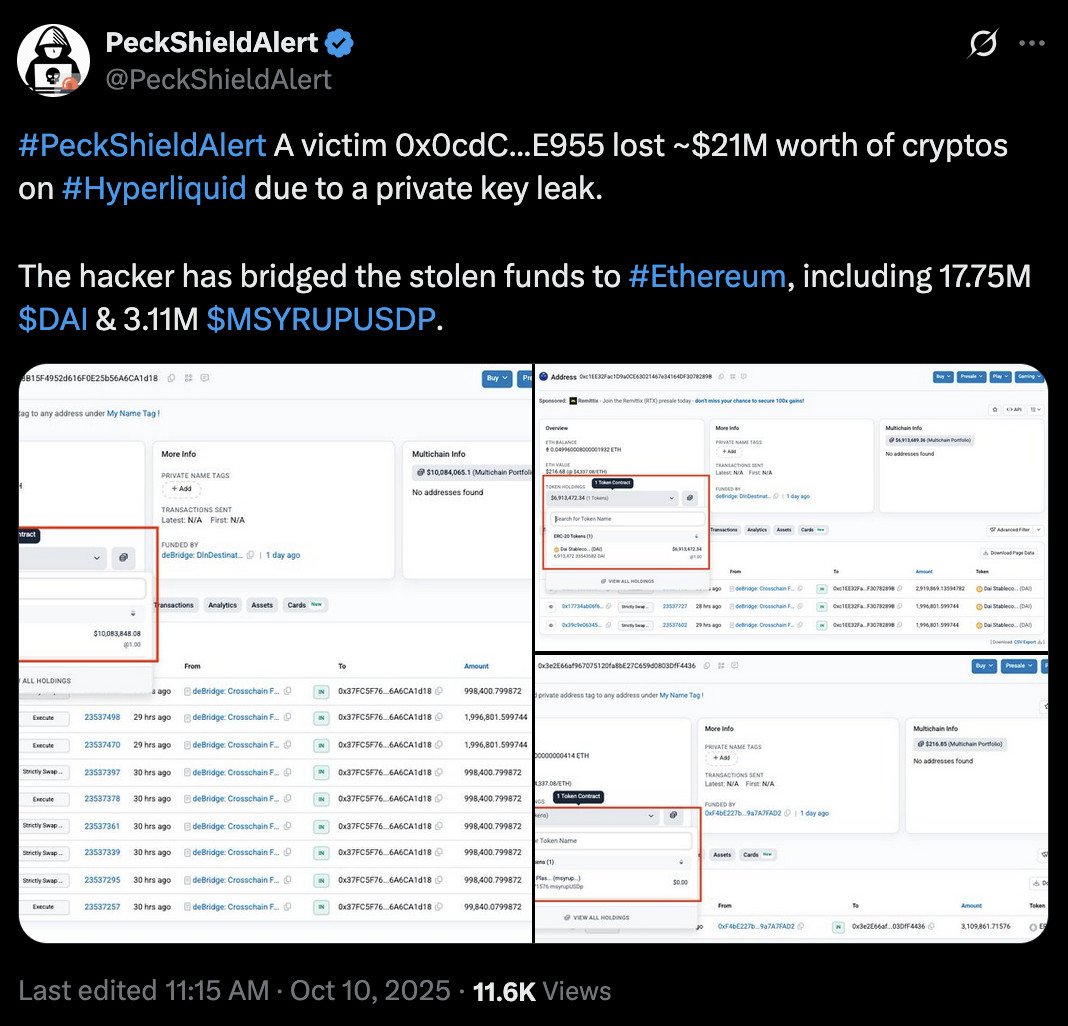

A Hyperliquid trader lost $21M after a private key leak exposed serious DeFi security flaws.

A Hyperliquid trader lost $21M after a private key leak exposed serious DeFi security flaws. Most DeFi hacks stem from weak wallet protection and excessive permissions.

Most DeFi hacks stem from weak wallet protection and excessive permissions. Best Wallet Token ($BEST) introduces Fireblocks MPC-CMP tech for stronger user security.

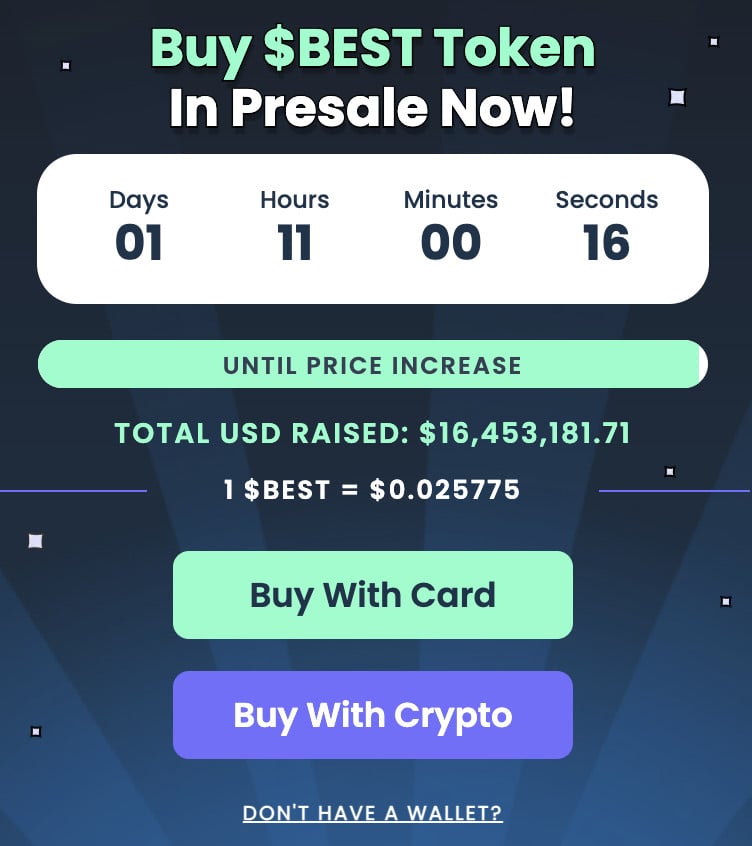

Best Wallet Token ($BEST) introduces Fireblocks MPC-CMP tech for stronger user security. With $16.4M raised in presale, $BEST is gaining traction as a safer DeFi investment option.

With $16.4M raised in presale, $BEST is gaining traction as a safer DeFi investment option.

According to blockchain security firm PeckShield, the attacker drained 17.75M $DAI and 3.11M $MSYRUPUSDP from the platform’s Hyperdrive protocol, then bridged the funds straight to Ethereum.

That’s not just an unlucky day. It’s a reminder that even the smartest DeFi traders still forget one golden rule: your wallet security is everything.

Hyperliquid has been booming lately – over $3.5B in trading volume this week and a massive airdrop to 94K+ users. But as DeFi grows, so does the risk. Every new reward system and airdrop attracts more traders, and more hackers.

It’s like parking a Ferrari with the doors unlocked in a rough neighborhood.

That’s why people are starting to look for something safer – a way to earn and trade without constantly worrying about their private keys.

One name that keeps popping up is Best Wallet Token ($BEST). It’s building an all-in-one, security-first ecosystem that could help stop exactly the kind of disaster that just hit Hyperliquid.

What Best Wallet Token Does – And Why It’s Getting Attention

Best Wallet Token ($BEST) is the backbone of Best Wallet, a new-generation crypto platform built to challenge outdated apps like MetaMask.

While most wallets still feel like clunky tools from 2017, Best Wallet is positioning itself as the next evolution, combining advanced tech, intuitive design, and real rewards for users.

That means private keys aren’t stored in one place, reducing the risk of hacks and exploits like the $21M Hyperliquid loss that’s shaken the DeFi community.

But it’s not just about safety. Best Wallet’s standout feature, Upcoming Tokens, is changing how presale buyers operate. Instead of navigating shady mirror sites or fake Telegram links, users can join verified token presales directly inside the app.

It’s safer, faster, and perfect for anyone chasing new crypto projects before they hit exchanges.

The platform’s growth numbers show real momentum: a 70K-strong social following and a 50% monthly user growth rate (self proclaimed).

With these foundations, the $BEST token becomes more than just another utility coin – it’s a ticket to a growing DeFi ecosystem that’s aiming to redefine what ‘secure and user-friendly’ means in crypto.

Why People Are Buying $BEST Now

At $0.025775 per token and $16.4M raised in presale, $BEST is attracting early investors who see the link between security and profit.

The token gives holders reduced transaction fees, early access to new projects, higher staking rewards, and even a voice in ecosystem governance.

All while being tied to a platform designed to prevent the same mistakes that cost Hyperliquid users millions.

After the $21M private key exploit, traders are finally realizing that ‘wallet security’ isn’t just a slogan. It’s survival.

The $21M Hyperliquid exploit wasn’t a freak accident. It was a warning shot. As DeFi scales, security isn’t optional – it’s survival.

Best Wallet Token ($BEST) isn’t promising miracles, but it’s offering something traders desperately need: a safer way to live the crypto life.

This article is for informational purposes only. Always do your own research (DYOR) before buying any token.

You May Also Like

Fed forecasts only one rate cut in 2026, a more conservative outlook than expected

XRPL Validator Reveals Why He Just Vetoed New Amendment