Virtuals Protocol: Why are we launching Unicorn, our new launch pad?

Author: Virtuals Protocol

Compiled by: TechFlow

Why change?

We believe that in the future agents will surpass humans, and global productivity will shift from human GDP to agent GDP (aGDP).

Every part of Virtuals plays a role in this mission:

- Butler connects people with AI agents, making interaction and coordination seamless.

- ACP (Agentic Core Protocol) provides an economic foundation for agents, a permissionless transaction, trade, and collaboration layer.

- The creation of Virtuals Launchpad addresses the most critical aspect: co-ownership of agents.

The original intention of Virtuals Launchpad was to enable anyone to co-own intelligent entities that shape the future AI economy. However, our first launch model, Genesis, failed to achieve this vision.

Genesis starts with fairness. Every Virgen (Virtuals Protocol participant) can participate through points. The participation threshold is equal, the contribution threshold is high, and every project has visibility.

Genesis pursues fairness, but like Icarus, it flies too high and eventually falls.

Deep Tide Note: "Icarus" is a figure in Greek mythology who, along with his father, Daedalus, escaped Crete by crafting wings from wax and feathers. Daedalus warned Icarus not to fly too high (towards the sun) or too low (towards the sea). However, Icarus, overwhelmed by the thrill of flight, flew too high, and the sun's heat melted the wax on his wings, causing him to fall into the sea and drown.

But fairness has turned into scoring.

The entire system has become about collecting points, not faith. Virgens rotate from one platform to another, racking up points, staking, selling, and leaving. The cycle repeats.

High-quality founders are unable to raise meaningful funding.

The system lacks a built-in fundraising mechanism, with only small transaction fees, which has led talented developers to avoid the platform entirely. The result: Virgens' returns have dwindled, project quality has declined, and user confidence has been eroded. While fairness exists, it's unsustainable.

We realized that if we wanted people to truly co-own the AI agents that define the future, we needed a new model—one that made ownership meaningful again, rewarded early conviction, attracted high-quality founders, and created a home for agents worth living.

That’s why we built Unicorn, a launchpad system to nurture the next billion-dollar agency.

What has changed?

Unicorn is designed around belief, not convenience.

- It gives Virgens the freedom to take authentic positions and rewards them for good judgment.

- It provides founders with the capital to build long-term structures and grow based on results.

What the she-wolf was to ancient Rome, the Unicorn is to the new era of AI ownership.

How it works

Unicorn is built for true faith, for Virgens who can discover faith early, and for founders who can prove faith.

Every project starts small, allowing anyone to trade, and eventually scales to hundreds of billions of dollars. Early confidence will bring huge rewards.

Founders are protected, held accountable, and only receive funding when they achieve real growth.

That’s how we make winning meaningful again.

i. Creation phase

- Founders need to pay a one-time creation fee of $100 VIRTUAL to start the project.

- Once created, a dedicated proxy launch page will be published on the Virtuals Protocol platform, displaying all core project details, token supply, founding team, and launch parameters.

- There is a minimum 24-hour evaluation window between page creation and public trading. This allows the community time to review, discuss, and evaluate each project before liquidity is released. Trading will then begin.

ii. Start-up and Early-stage Transactions

- Transactions start at lower initial valuations, providing early-stage Virgens with asymmetric, often extraordinary upside to discover conviction before others.

- Anyone can participate directly through the Virtuals Protocol interface, with no pre-sales, whitelists, or allocation restrictions required.

- To maintain fairness, the Anti-Sniper Tax will be enabled at startup.

Anti-Sniper Tax: The initial tax rate is 99% and decays linearly to 1% over time. All collected taxes will be used to repurchase proxy tokens to strengthen the market and reward genuine participants.

The system prevents bot takeover and transforms volatility into constructive liquidity growth.

iii. Team Distribution and Fundraising Mechanism

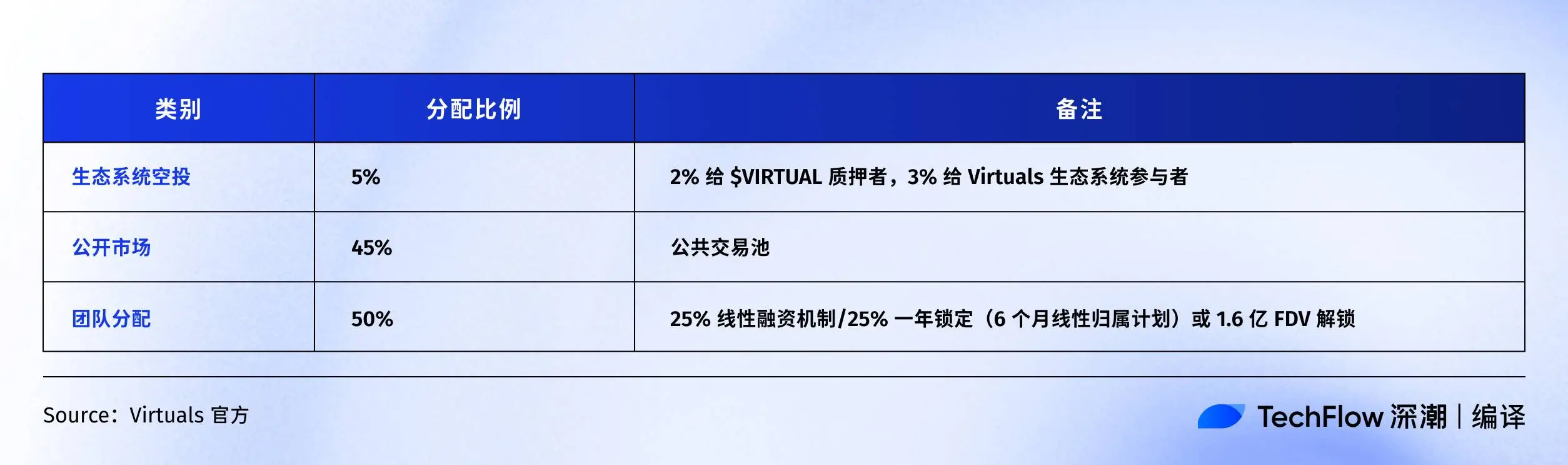

- 50% of the total supply is reserved for the founding team.

- 25% is distributed linearly through limited price sale fundraising, starting only when the project reaches 2 million FDV and continuing until 160 million FDV.

- These sales will be executed automatically and transparently as the project grows.

- Founders only receive benefits when they gain traction in the actual market, and funding is tied to performance, not promises.

- The remaining 25% will be unlocked one year after the TGE on a six-month linear vesting schedule, or when the project reaches 160 million FDV, whichever comes first.

This dual team allocation structure ensures that founders receive both financial support and accountability, preventing them from selling out early and instead securing growth funding by building value over the long term.

iv. Ecological Airdrop

Each Unicorn release allocates 5% of the total supply to real Virgens:

- 2% allocated to $VIRTUAL stakers

- 3% allocated to active Virtuals ecosystem participants

Airdrops are distributed weekly, and snapshots are linked to $VIRTUAL staking and Virtuals ecosystem activities.

This means that every proxy launch will directly reward $VIRTUAL stakers and active Virtuals Protocol ecosystem participants.

Transition from a points system

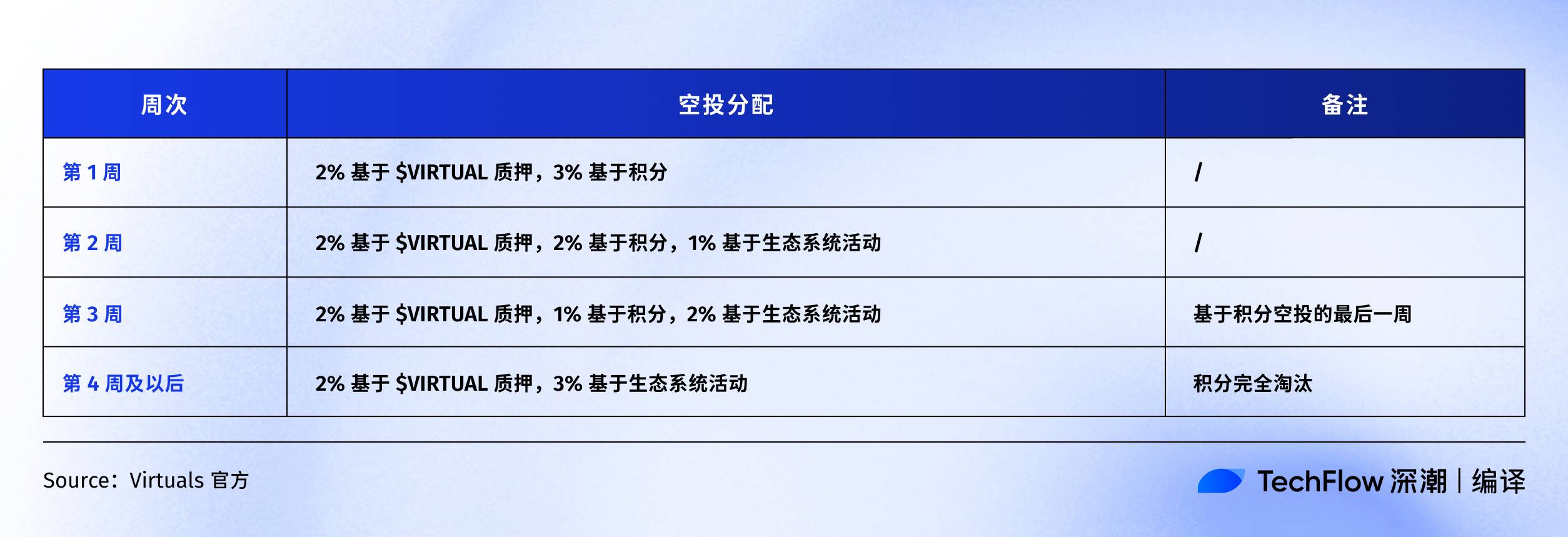

As we transition from Genesis to Unicorn, airdrops will gradually shift from the old points system to the new $VIRTUAL staking and Virtuals ecosystem activity model.

During the transition period, all existing points will still generate airdrops based on the number of points held, and will also receive rewards based on $VIRTUAL staking and Virtuals ecosystem activities.

Prior to the launch of Unicorn, a snapshot of all existing points balances will be taken. Airdrop distribution will then follow a three-week transition plan until full migration to the new model is complete.

Token Allocation Key

The road ahead

Genesis was an experiment, a bold attempt to ensure a fair and transparent product launch. It succeeded to a certain extent, but fairness alone is not enough. Small victories don't build a lasting market.

Fire is the first spark of humanity, and agency ownership is the next.

Unicorn rewards belief, provides funding for real developers, and makes ownership meaningful again - ownership that drives the rise of Agentic GDP and real problem solving.

This is how we'll move forward: helping Virgens co-own the AI agents that define the next economy and attract founders who can build for the long term. When Virgens win, Virtuals win. This is the only way forward.

Unicorn, stay tuned!

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon