All Eyes On Solana: $15-B Stablecoin Supply, ETF Demand Drive Next Leg Up

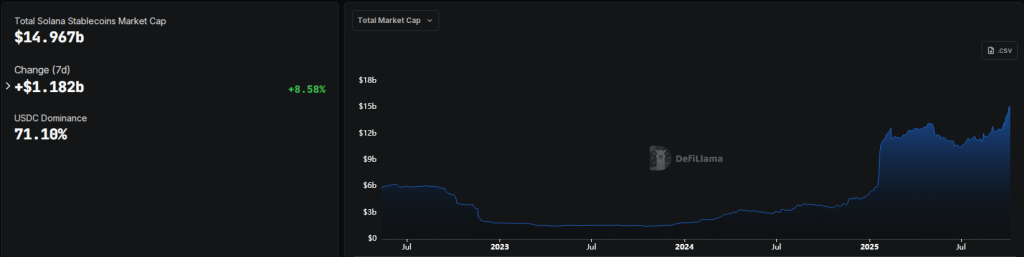

Investors have piled into Solana-linked products and on-chain cash, pushing the network back into the spotlight. Based on reports, the total supply of stablecoins sitting on Solana recently climbed to about $15 billion, a new peak that traders say is adding fuel to activity on the chain.

Stablecoin Liquidity Hits A Milestone

The bulk of that supply is held in USDC, which accounts for roughly 75% of stablecoins on Solana, according to analytics cited by market commentators. That concentration has helped trading desks and decentralized apps move larger sums with less friction than on some rival chains.

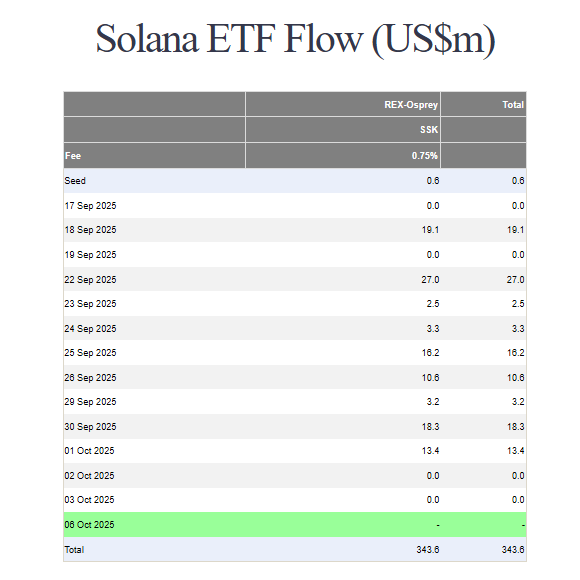

On top of the on-chain cash, US-listed ETFs tied to Solana and related products have recorded fast early takeup, giving institutions a simpler route into the token and staking rewards.

The REX-Osprey SOL + Staking ETF, known by the ticker SSK, passed the $100 million AUM mark within days of launch, showing how appetite for regulated access to Solana can materialize quickly.

ETFs Bring Fresh Flows And Visibility

Reports show that REX-Osprey’s suite of crypto ETFs has now crossed half a billion dollars in combined assets under management, a sign that product innovation on Wall Street is translating into real capital flows into the sector.

Market watchers say ETFs let big investors get exposure without interacting directly with wallets and custody solutions.

Network Upgrades, Use Cases Part Of The Move

Network Upgrades, Use Cases Part Of The Move

Observers point to recent code upgrades and faster settlement as part of why more stablecoins are parked on Solana. Those changes aim to reduce delays and lower costs for traders who move USDC and other dollar-pegged tokens.

Although technical gains in and of itself do not produce price movement, they can enhance a network’s attractiveness for high-frequency activity and for projects focused on tokenized assets that require transaction finality.

Regulation and approvals in the United States have influenced this impulse. Asset managers have filed for Solana ETFs and modified their necessary paperwork with the SEC while awaiting permits to list a product tied to the token.

According to a recent reports, multiple firms have updated their submissions while the regulator is still reviewing.

The broader political backdrop, including comments from US President Donald Trump and others, has kept attention on how policy could tilt institutional demand.

Featured image from Unsplash, chart from TradingView

You May Also Like

Shocking OpenVPP Partnership Claim Draws Urgent Scrutiny

Telos Advisers Welcomes Stephen Gardner as a Strategic Advisory Board Member