CryptoPunks Price Jumps 9.5% as Trade Volume Skyrockets

- CryptoPunks price jumped 9.5% in 24 hours, reaching $197,159 with rising trade volume.

- Daily sales climbed 42.9% with $1.87M volume, signaling renewed NFT market interest.

The price of the most iconic NFT collection, CryptoPunks, has once again attracted attention.

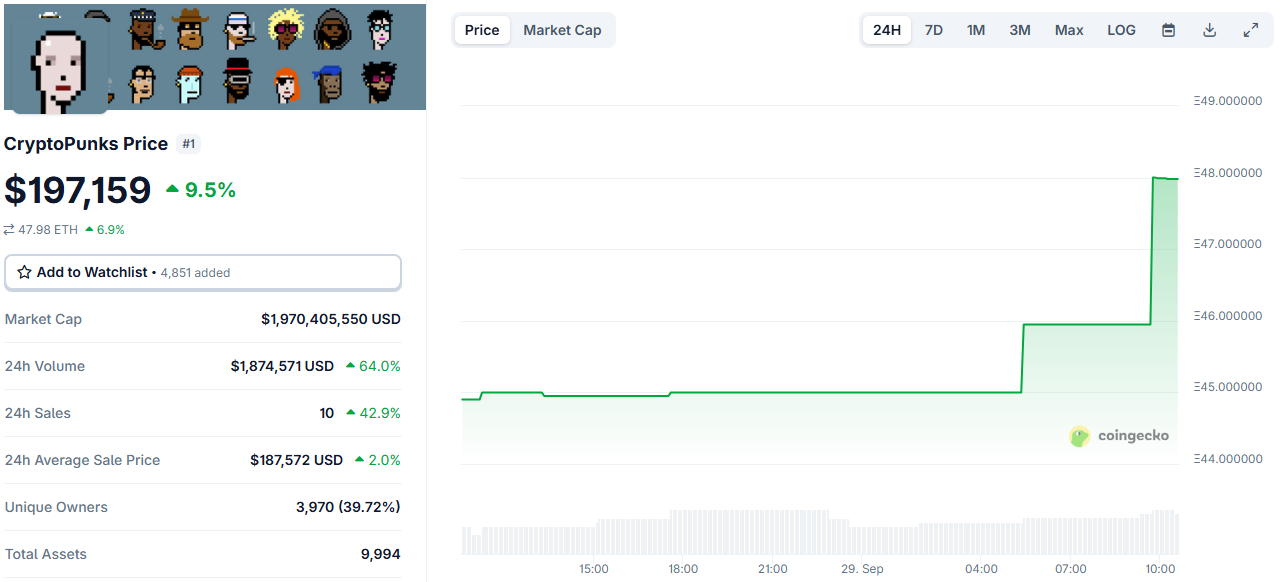

According to CoinGecko, in the past 24 hours, the average price of this collection has risen 9.5% to reach around $197,159, equivalent to approximately 47.98 ETH.

This increase certainly feels quite strong amid the NFT market, which has appeared sluggish in recent months. The market capitalization of CryptoPunks now stands at around $1.97 billion, indicating its continued appeal despite a significant decline from its peak in 2021.

Source: CoinGecko

Source: CoinGecko

Furthermore, trading activity in the past day has also surged. The latest data shows that transaction volume reached $1.87 million, an increase of approximately 64%.

Meanwhile, the number of sales reached 10 transactions, a 42.9% increase compared to the previous day. The average sale price is around $187,572, a slight increase of around 2%.

Of the 9,994 CryptoPunks NFTs in circulation, there are approximately 3,970 unique wallets holding them, representing 39.72% of the entire collection.

Old but Gold: CryptoPunks Still Attracting Strong Demand

While the current figure is still far from the record high reached in October 2021, when the average price reached $477,924, the recent trend is quite encouraging.

Currently, the price of CryptoPunks is still 58.8% below its all-time high, but the increase in the past 24 hours has clearly provided a boost for collectors and traders. Furthermore, this surge seems to emphasize that these over six-year-old NFTs still hold a special place in the digital market.

Returning to the end of July, the CNF reported that daily trading volume for CryptoPunks surged by over 229%, while sales rose 227% in just 24 hours. These figures indicate a resurgence in investor interest. This pattern is similar to what is currently being seen, where price, volume, and sales move in tandem.

Fresh NFT Trends Show Strong Community Engagement

On the other hand, when compared to other NFT ecosystems, a positive trend is also emerging. Last August, we highlighted how Telegram NFT gifts managed to record sales of over $57.7 million on the primary market.

Interestingly, over 357,000 unique wallets are already involved in trading these digital gift-based NFTs in the TON ecosystem. This phenomenon demonstrates that while many people’s focus is on established assets like CryptoPunks, new projects are also capable of capturing the community’s attention with different models.

The price movement of CryptoPunks in the past 24 hours has certainly become a hot topic of conversation, especially for those who still hold onto their long-standing collections.

The question is, is this surge just a passing fad or the beginning of a longer-term revival? Given the increasing volume and sales data, there’s reason to believe the market still has some energy.

]]>You May Also Like

Top 5 Trending Cryptos Today: What’s Hot in the Market

Google Becomes Latest in Agentic AI Stablecoin Payments Race