Aster ignited the whole audience, how will Hyperliquild respond?

Global Sustainable DEX Market Overview and Industry Changes

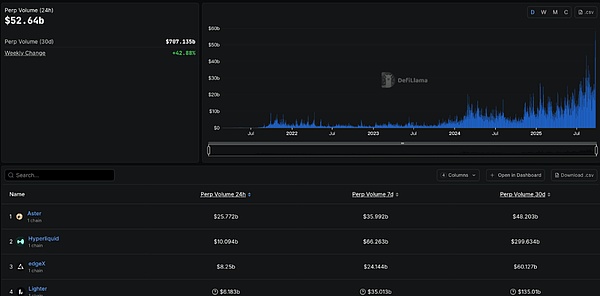

The decentralized perpetual swap market is experiencing an unprecedented surge in growth and a reshaping of the competitive landscape. By September 2025, global perp DEX daily trading volume had exceeded $52 billion, a 530% increase from the beginning of the year, with cumulative monthly trading volume reaching $13 trillion. This growth is driven by breakthroughs in technological innovation, growing user demand for decentralized financial products, and regulatory pressure on centralized exchanges. The sector as a whole now accounts for approximately 26% of the crypto derivatives market, a substantial leap from the single-digit share in 2024.

Perp DEX total transaction volume changes https://defillama.com/perps

Rapid market differentiation is reshaping the competitive landscape. Traditional order book models (such as dYdX and Hyperliquid) dominate professional trading with precise price discovery and deep liquidity, while AMM models (such as GMX and Gains Network) attract retail users with instant liquidity and simplified operations. Emerging hybrid models (such as Jupiter Perps) attempt to combine the advantages of both, using a keeper system to achieve seamless transitions between order book and AMM in a high-speed environment. Data shows that the order book model is gaining market share. Hyperliquid, with its CLOB architecture, has processed $2.76 trillion in cumulative trading volume.

The rise of Aster DEX and its market impact

Aster, formed by the merger of APX Finance and Astherus, achieved a meteoric rise from zero to top in just a few weeks through a multi-chain aggregation strategy and the support of YZi Labs, particularly CZ. Its 1,650% gain on the first day of its TGE (Trading General Evolution) on September 17th, along with $371 million in trading volume and an influx of 330,000 new wallet addresses, fully demonstrated its strong market acquisition capabilities.

Aster's technological innovations are primarily reflected in improved user experience. Its Simple mode offers up to 1001x leverage, far exceeding Hyperliquid's 40-50x. While risky, this approach is highly attractive to speculators seeking high returns. The hidden order feature draws on the concept of dark pools in traditional finance, effectively protecting large transactions from MEV attacks. The yield integration feature allows users to use interest-bearing assets like BNB as margin, earning a base yield of 5-7% while trading. This innovation maximizes the composability of DeFi.

Aster's TVL surged 328% from $370 million on September 14th to $1.735 billion, with BNB Chain contributing 80% of this. Daily trading volume exceeded $20 billion multiple times, surpassing Hyperliquid to become the world's largest perpetual DEX, with 24-hour fee revenue reaching $7.12 million. More importantly, Aster amassed $19.383 billion in cumulative perpetual trading volume in just a few months. While still a step below Hyperliquid's $2.76 trillion, the growth rate was astonishing.

Community discussions revealed a clear divergence in traders' preferences for the two platforms. Professional traders preferred Hyperliquid, believing its "single block confirmation" and deep liquidity were essential for professional trading. Meanwhile, cross-chain users and beginners preferred Aster, whose bridge-free multi-chain support and CEX-like user experience significantly lowered the barrier to entry.

Hyperliquid: Technologically advanced but market share under pressure

As a pioneer in the perpetual DEX space, Hyperliquid has redefined the possibilities of on-chain derivatives trading with its innovative HyperCore architecture. HyperCore achieves a processing capacity of 200,000 orders per second and a latency of 0.2 seconds, surpassing even many centralized exchanges. With cumulative perpetual swap volume of $2.765 trillion, current open interest of $133.5 billion, and a 24-hour trading volume of $15.6 billion, these figures fully demonstrate the success of its technical architecture and the trust of its users.

However, Hyperliquid is facing a continued decline in market share. Its share of the perpetual DEX market has fallen from 71% in May 2025 and 80% in August to 38% today. This change is primarily due to the rapid rise of emerging competitors and the success of its multi-chain strategy. In particular, Hyperliquid has been repeatedly surpassed by Aster DEX in terms of daily trading volume and fee revenue, a change that was previously unimaginable.

Perpdex trading volume statistics perpetualpulse.xyz

Despite the challenges, Hyperliquid's advantages remain clear. It boasts the deepest liquidity, with spreads as low as 0.1-0.2 basis points for major assets like BTC/ETH; the most stable technical architecture, with single-block confirmations providing traders with unparalleled certainty; and the most mature ecosystem, with over 100 projects building comprehensive DeFi infrastructure on its platform. More importantly, its deflationary model, which allocates 99% of protocol revenue to buyback and burn HYPE tokens, has generated $20.1 billion in annualized revenue, providing strong support for its value proposition.

From the perspective of user quality, Hyperliquid demonstrates higher user value. Among its 825,000 daily active addresses, 3.651 million are monthly active users, and the ratio of open interest to trading volume (OI/Volume) reaches 287%, significantly higher than the industry average. This metric suggests that Hyperliquid's users are more likely to engage in genuine risk hedging rather than short-term speculative trading. In contrast, Aster's user base is only 12%. Despite its higher daily trading volume, its user behavior is more inclined towards short-term arbitrage.

Faced with competitive pressure, Hyperliquid is actively adjusting its strategy. The upcoming HIP-3 (Permissionless Perpetual Markets) will allow anyone to deploy custom perpetual contracts. This could lead to innovative products like RWA perpetuals and AI computing power futures, revitalizing the ecosystem. The launch of the USDH native stablecoin will further enhance its financial infrastructure. With an estimated $5.5 billion in funds under management and 95% of proceeds allocated for HYPE buybacks, this will significantly enhance its value proposition.

In this fiercely competitive market, Hyperliquid's true moat lies not simply in its technology itself, but in the complete ecosystem built around its core protocol. From its humble beginnings as a perpetual trading platform to its current comprehensive DeFi ecosystem of over 100 projects, Hyperliquid has established a self-contained financial infrastructure. This ecosystem encompasses a full-stack solution, from infrastructure and DeFi protocols to the application layer, with each component contributing to the network's value accumulation and user engagement.

It is against this backdrop that this article will delve into the core projects and innovative applications within the Hyperliquid ecosystem, exploring how these projects build sustainable competitive advantages for Hyperliquid amidst fierce market competition, and how they collectively shape the future of decentralized derivatives trading.

In-depth analysis of Hyperliquid's core ecological projects

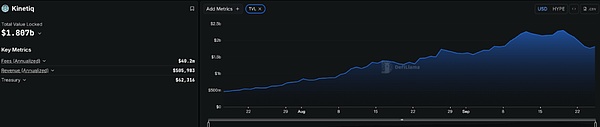

1. Kinetiq - Liquidity Staking Ecosystem Pillar (TVL: $1.757 billion)

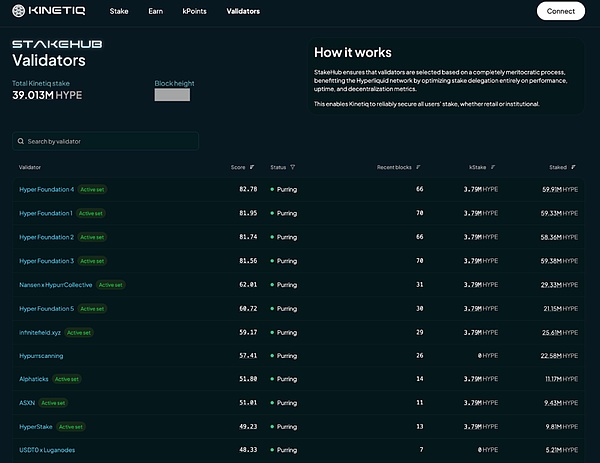

Kinetiq holds an unshakable position within the Hyperliquid ecosystem, with a TVL of $1.757 billion, representing approximately 78% of the ecosystem's total value, making it a central hub for capital flows. As the "Jito" of the ecosystem, Kinetiq has redefined validator delegation through its innovative StakeHub algorithm, achieving unprecedented efficiency and yield optimization.

The core of the StakeHub algorithm lies in a sophisticated, multi-dimensional scoring system. This system scores over 100 active validators in real time, dynamically adjusting fund allocation strategies based on metrics such as reliability (40% weight), security (25% weight), economic performance (15% weight), governance participation (10% weight), and operational history (10% weight). This algorithm not only considers a validator's historical performance but also predicts its future stability. Using machine learning models, it continuously optimizes allocation weights to ensure that delegated funds always flow to the highest-quality validators.

Kinetiq node operation status https://kinetiq.xyz/validators

The protocol offers a rich and market-leading revenue structure. Base PoS rewards yield approximately 2.3% annualized returns, placing it at the top of the heap among similar LST projects. StakeHub optimizations provide an additional 0.2-0.5% enhanced return by preventing underperforming validators from participating. MEV revenue contributes approximately 1% annualized returns, derived from the Hyperliquid network's MEV capture mechanism. Even more compelling are integration rewards with other DeFi protocols, offering a variable 6-8% bonus, bringing total returns to 10-12%, a highly competitive level in the current DeFi landscape.

Kinetiq offers a streamlined user experience. Users stake HYPE to earn kHYPE, enjoying a slight premium of 1:0.996. This premium reflects the market's added value for liquidity staking and confidence in the protocol's security. The unstaking mechanism incorporates a 7-day security delay and a 0.1% fee, providing users with a reasonable exit mechanism while ensuring network security.

Kinetiq has seen explosive growth, tripling its TVL from $458 million in July to $1.81 billion today. This growth is primarily due to the integration of the Pendle protocol, which created additional liquidity demand and yield strategies for kHYPE through its PT/YT split mechanism.

The upcoming launch of $KNTQ provides a crucial tool for decentralized governance and long-term value creation within the protocol. An estimated 30-50% of the supply will be distributed to the community via airdrops, with priority allocations given to points holders, early adopters, and kHYPE stakers. $KNTQ's core functions include voting on protocol upgrades, determining MEV routing policies, and curating the HIP-3 market. This decentralized governance will further enhance the protocol's decentralization and community engagement.

How it works: Users stake HYPE on kinetiq.xyz to earn kHYPE, which is instantly minted and has a seven-day lock-up period. The protocol also offers a kPoints system, which distributes points weekly in preparation for the upcoming $KNTQ airdrop. Points are earned based on various metrics, including staked amount and holding duration.

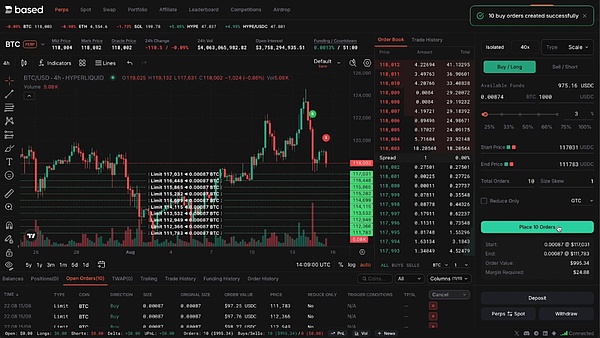

2. Based - Mobile Super App and Ecosystem Portal

Based, the highest-grossing Builder app on Hyperliquid, generated approximately $90,300 in 24-hour revenue, ranking first among all third-party apps. Its cumulative perpetual trading volume exceeded $16.699 billion, with a 24-hour perpetual trading volume of $321 million. It processes approximately 7% of Hyperliquiqui's total trading volume, a figure that fully reflects the high-net-worth nature and deep engagement of its user base. Its revenue model leverages Hyperliquid's Builder fee-sharing system, offering a maximum commission share of 0.1% on perpetual trading and 1% on spot trading. The majority of this revenue is returned to users in the form of commissions through an affiliate marketing program, creating a sustainable incentive structure that benefits users, the platform, and Based. With $2.22 million in 7-day revenue and $6.71 million in 30-day revenue, these metrics not only demonstrate the robustness of its business model but also highlight its key role as a revenue contributor within the Hyperliquiquid ecosystem.

Based trading interface https://www.basedapp.io/

Based's economic design reflects a deep understanding of user behavior and innovative incentive mechanisms. $PUP, an XP-accumulating tool, completed its airdrop on August 22, 2025. The total supply is 100 million, with 5% allocated to early users and community contributors. $PUP's primary function is to increase users' XP acquisition efficiency, providing a 25-60% point multiplier, enabling holders to earn more rewards through activities like trading and spending. $BASED will be distributed based on users' total XP, with a snapshot date of September 20, 2025. Perpetual trading will contribute 0.06 XP for every $1 of notional trading volume, spot trading will contribute 0.30 XP for every $1 of trading volume (a 5x incentive), and Visa spending will contribute 4-6 points for every $1 spent (converted to XP at the TGE).

This dual mechanism cleverly combines short-term incentives ($PUP bonus) and long-term governance ($BASED allocation). $PUP holders essentially gain the "leverage" of $BASED airdrops, further strengthening user loyalty and ecosystem stickiness. Within the community, $PUP has a circulating market capitalization of approximately $5 million, with a price stable at around $0.05, demonstrating robust demand as a utility. $BASED's projected supply is 1 billion, with a community allocation of 40%, expected to be fairly distributed to active users through the XP system.

Interaction: Users can download the mobile app or visit the website through based.markets, register an account using their email address, and top up assets across multiple chains with one click. The trading interface, designed similarly to traditional financial applications, offers spot and perpetual trading capabilities. Users can also apply for a Visa debit card (existing users should note the November deactivation schedule) for fiat currency spending. The XP system displays points progress in real time, and $PUP holders can activate bonuses in their wallet to improve rewards efficiency.

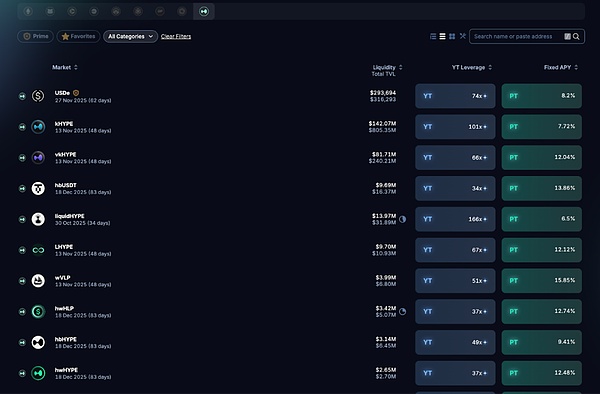

3. Pendle - The Monetization Protocol Giant

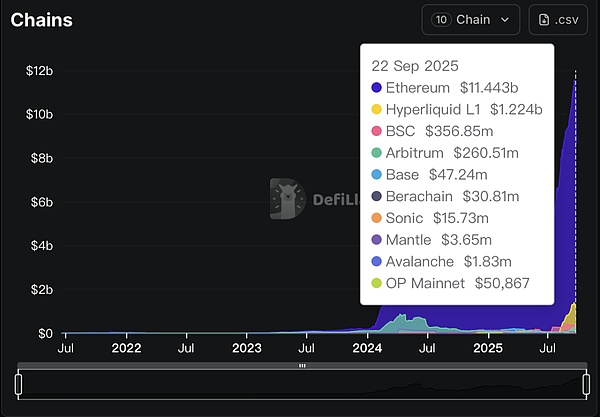

Pendle's successful deployment on the HyperEVM marks the maturity of the yield farming concept within the Hyperliquid ecosystem and represents a new level of sophistication and innovation in DeFi products. By separating interest-bearing assets like kHYPE into PT (principal) and YT (yield), the protocol provides investors with a precise tool for both fixed-income investment and yield speculation. In just a few months, Pendle's TVL on the HyperEVM has grown from zero to $12.3 billion, a 30-day increase of 76.27%.

Pendle TVL distribution in various chains https://defillama.com/protocol/tvl/pendle

The synergy between Pendle and Kinetiq is a key factor in its rapid success within the Hyperliquiquic ecosystem. This synergy is reflected not only in product complementarity but, more importantly, in the creation of a new value capture mechanism. By converting kHYPE into PT and YT, Pendle provides liquidity staking users with more diverse income strategies and creates a new avenue for earning points through Kinetiq's points system. Users holding YT-kHYPE receive the full returns of Kinetiq's points rewards without the risk of principal fluctuations. PT-kHYPE holders enjoy the certainty of a fixed income, which can be used to build a stable income strategy.

Pendle's product portfolio continues to expand, demonstrating its strategic intent to deeply integrate with the Hyperliquid ecosystem. In addition to the mainstream kHYPE market, the protocol has also gradually supported the yield farming of ecosystem-based interest-bearing assets such as feUSD, hwHLP, and beHYPE. Each new asset adds new yield strategies and arbitrage opportunities, further boosting the activity and composability of the entire ecosystem. In particular, with the emergence of more LST and yield-generating assets, Pendle provides standardized yield-separation tools for these assets, becoming a crucial bridge connecting different protocols.

Interaction: Users access the protocol through app.pendle.finance and select the Hyperliquid network. They can then split their holdings of interest-earning assets like kHYPE into PT/YT, or trade these yield products directly in the secondary market. The protocol provides intuitive yield curves and maturity information to help users make investment decisions.

Pendle in HyperrEVM

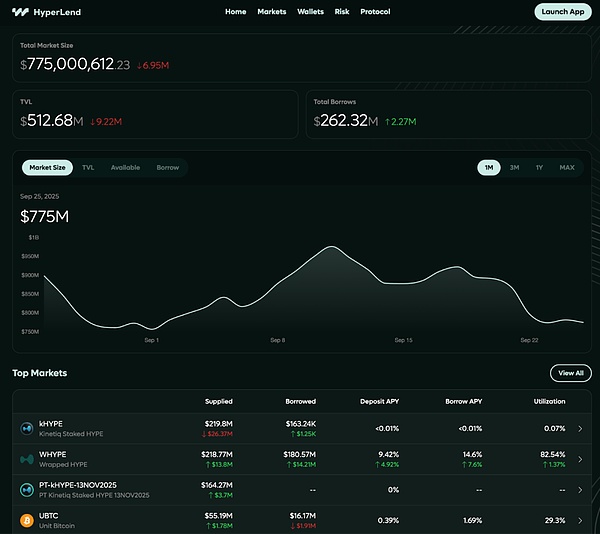

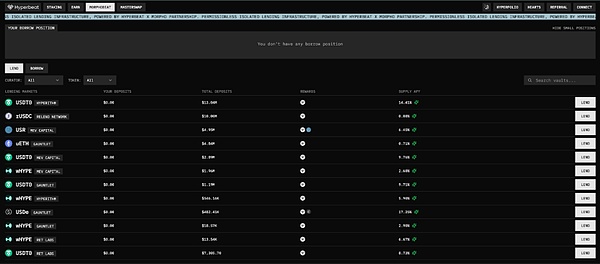

4. HyperLend - Lending Infrastructure Core

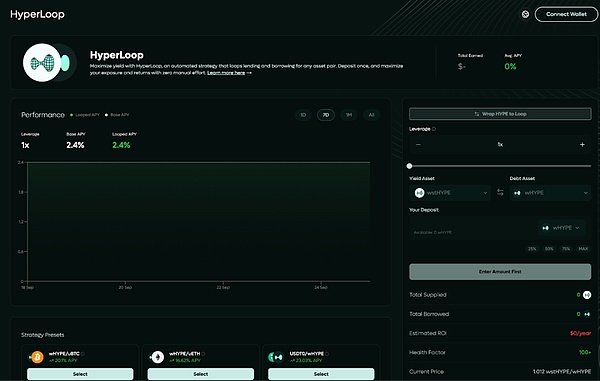

As the "credit bank" of the Hyperliquid ecosystem, HyperLend plays a crucial role in the entire DeFi infrastructure, providing core support for the ecosystem's liquidity cycle and capital efficiency. The protocol leverages the market-proven Aave V3 fork architecture, but with in-depth optimizations and innovations tailored to Hyperliquid's high-performance environment and unique asset characteristics. Its greatest technological breakthrough lies in the HyperLoop feature, an innovative mechanism that enables one-click leveraged circulation through flash loans, providing advanced users with unprecedented capital efficiency tools while maintaining operational simplicity.

HyperLend's architectural design embodies a delicate balance between risk management and capital efficiency. The protocol innovatively utilizes a dual-pool architecture: a unified liquidity pool dedicated to efficient lending and borrowing of core assets such as HYPE, kHYPE, and USDC, significantly reducing transaction slippage and improving capital utilization through a shared liquidity mechanism; and a segregated risk pool dedicated to handling assets with higher volatility or risk, supporting fully customizable risk parameters to ensure that risk events involving a single asset do not impact the stability of the entire system.

The technical implementation of the HyperLoop feature demonstrates the ultimate application of DeFi composability and a significant improvement in user experience. Users operate through a simple and intuitive interface, and the protocol automatically executes a complex sequence of atomic operations on the backend: first borrowing the target debt asset through a flash loan mechanism, then exchanging it for the yield asset the user wishes to hold through a built-in DEX aggregator, supplying this asset as collateral to the corresponding pool of the protocol, then borrowing more debt assets based on the newly added collateral, and finally repaying the initial flash loan. This entire complex sequence of operations is completed atomically within a single block, allowing users to easily achieve 3-5x leverage without the complexity, time cost, and gas fees of multiple manual operations.

HyperLoop's one-click revolving loan interface

Judging from its asset composition and operational efficiency, HyperLend demonstrates healthy and stable development and good market adaptability. Its total TVL of $524 million is primarily comprised of wstHYPE ($254 million, 48%) and native HYPE ($206 million, 39%). This asset distribution clearly reflects the importance of LST within the ecosystem and the strong demand for liquidity. With a current total borrowing volume of $267 million, the overall utilization rate has reached 48%, a healthy operating range for DeFi lending protocols. This ensures sufficient liquidity to meet withdrawal needs while optimizing capital utilization to achieve reasonable returns.

HyperLend's protocol scale

HyperLend's revenue model demonstrates clear and sustainable business value creation. The protocol generates annualized revenue of $15.89 million, with diversified and stable revenue streams primarily comprised of lending interest rate spreads, clearing fees, and flash loan fees. Of particular note is its flash loan fee, set at 0.04%, significantly lower than Aave's standard 0.09%. This competitive pricing strategy maintains market competitiveness while providing users with better cost efficiency, helping to attract more high-frequency trading and arbitrage activities. The protocol also incorporates a robust points system, which has been operating for 22 consecutive weeks, accumulating points in preparation for the upcoming $HPL airdrop, with 3.5% of the supply reserved for the Aave DAO.

Interaction: Users connect their wallets via hyperlend.finance, which supports deposits to earn interest, borrowing, and HyperLoop one-click leverage. The interface is simple and intuitive, providing real-time interest rate information and risk indicators to help users make informed lending decisions.

5. Hyperbeat - DeFi Super App (TVL: $387 million)

Hyperbeat positions itself as a one-stop DeFi hub, offering a comprehensive solution encompassing diverse services such as staking, lending, and yield optimization. The protocol recently completed a $5.2 million seed round led by Electric Capital, with participation from renowned institutions such as Coinbase Ventures, Chapter One, and DCF God. This funding round demonstrates institutional investor recognition of its business model and technical team.

Hyperbeat's product matrix embodies a deep ecosystem integration philosophy. The beHYPE liquidity staking module provides a scalable security model and supports governance participation. The Morphobeat lending market, optimized for interest-bearing assets like LST and based on the Morpho protocol, also leverages a Meta-Yield strategy to automate yield optimization and diversify risk across multiple protocols. Its cross-chain integration capabilities enable deployment on multiple chains, including Arbitrum. It currently holds $28.92 million in TVL on Arbitrum, expanding its user base and assets under management.

Hyperbeat's technological innovation lies primarily in its automated yield optimization strategy. The protocol uses smart contracts to automatically monitor yield fluctuations across various DeFi protocols and dynamically adjust capital allocation to achieve optimal returns. This "set-and-forget" user experience significantly lowers the technical barrier to entry for DeFi, making it particularly suitable for users who desire DeFi returns but prefer a more conservative approach. The Meta-Yield strategy also incorporates a risk hedging mechanism, mitigating the risk of a single protocol by diversifying investments across multiple protocols while leveraging arbitrage opportunities to enhance overall returns.

Interaction: Users access a multi-product dashboard at hyperbeat.org, offering one-stop DeFi operations such as staking, lending, and yield farming. The interface design prioritizes user experience, providing yield estimates and risk warnings. The Hearts points system is nearing its end, with less than 12% remaining for distribution. A total of 51 million Hearts points will be allocated for the upcoming $BEAT airdrop. This points system encourages users to remain active across multiple product modules, earning points through multi-faceted activities such as staking, lending, and yield farming.

6. USDH - Native Stablecoin Infrastructure

USDH, the upcoming native stablecoin of Hyperliquid, carries the important mission of improving the ecosystem's financial infrastructure. Native Markets won the community vote on September 14, 2025, securing the right to issue USDH. The launch of USDH will fill the gap in the Hyperliquid ecosystem's native stablecoin offerings, providing a more complete and autonomous financial infrastructure for the entire ecosystem.

USDH's technical architecture reflects a deep consideration of regulatory compliance and scalability. The stablecoin will be backed by U.S. Treasury bonds through traditional financial institutions such as Stripe Bridge and BlackRock, ensuring adequate asset collateralization and regulatory compliance. Importantly, USDH will be dually compatible with HyperEVM ERC-20 and HyperCore HIP-1. This design allows the stablecoin to flow seamlessly throughout the Hyperliquid ecosystem, serving as collateral and liquidity in DeFi protocols and as margin in perpetual swaps, achieving true ecosystem-native integration.

USDH is expected to launch in Q4 2025, with specific progress dependent on the completion of technical development and regulatory applications. As a critical infrastructure for the ecosystem, the successful launch of USDH will have a profound impact on the entire Hyperliquid ecosystem, not only improving user experience and capital efficiency but also, more importantly, strengthening the ecosystem's independence and sustainability. USDH's inherent advantages and revenue-sharing mechanism will provide it with unique competitive advantages, particularly in competition with external stablecoins like USDC.

Ecosystem Data Panorama and Development Outlook

The Hyperliquid ecosystem demonstrates strong growth momentum and healthy development. Its total TVL reached $6.535 billion, with $2.37 billion locked in DeFi protocols and $4.165 billion in perpetual swaps. Its 30-day perpetual swap volume reached $651.6 billion. User data demonstrates high-quality features, including 308,000 monthly active users, an average holding size of $162,000, and a 30-day retention rate of 67%, significantly exceeding similar platforms.

The ecosystem's greatest strength lies in the deep synergy between protocols. The integration of Kinetiq and Pendle, the capital efficiency amplification of HyperLend, the internal circulation of Felix feUSD, and the mobile traffic driven by Based have created a powerful network effect. However, the decline in market share cannot be ignored. Hyperliquid's share of the perpetual DEX market fell from 48.2% in August to 38.1% in September, primarily due to losses to competitors adopting multi-chain strategies and incentive mechanisms.

The launch of HIP-3 (Permissionless Perpetual Markets) will be a significant turning point, allowing anyone to deploy custom perpetual contracts and expected to usher in innovative products such as RWA perpetuals and AI computing power futures. The USDH native stablecoin is expected to manage $5.5 billion in funds, with 95% of its returns used for HYPE buybacks, resulting in an annualized return of $150-220 million, significantly enhancing its value proposition.

HYPE's value capture mechanism is well-designed: 99% of protocol revenue is used for buyback and destruction, with the current annualized buyback rate at approximately 8.7%. However, the linear release starting on November 29th will increase supply by 71%, requiring strong fundamental performance to offset supply pressure.

The Hyperliquid ecosystem stands at a critical juncture. Its success will depend on the integration of technological innovation and user experience, the balance between ecosystem openness and quality control, and the coordination of technological focus and diverse needs. The launch of HIP-3 and USDH will be a crucial test of its adaptability.

For investors, the ecosystem offers a wealth of investment opportunities, from the stable returns of the LST protocol to high-risk early-stage projects. The key is to understand the business models and risk factors of each protocol and develop a sound strategy based on your specific circumstances. Hyperliquid's value lies not only in the success of individual protocols, but also in the formation of network effects across the entire ecosystem. In an era fraught with both opportunities and challenges, its ability to continuously innovate and create value for users will determine its long-term prospects.

You May Also Like

Next Couple of Months Will Be Wild for XRP: Wealth Manager

Top 5 Cryptocurrency Data APIs: Comprehensive Comparison (2025)

- EODHD (End-of-Day Historical Data) — All-in-One Multi-Asset Data EODHD is a versatile financial data provider covering stocks, forex, and cryptocurrencies. It offers an unmatched data coverage with up to 30 years of historical data across the global For crypto, EODHD supports thousands of coins and trading pairs (2,600+ crypto pairs against USD) and provides multiple data types under one service. Key features include:

- CryptoCompare — Full Market Data + More CryptoCompare is a long-standing crypto data provider that offers a rich set of market data and analytics. It not only provides price data but also aggregates news, social sentiment, and even some on-chain data, making it a comprehensive source for crypto market Key features of CryptoCompare’s API include:

- Glassnode — On-Chain Analytics Leader Glassnode is the premier platform for on-chain metrics and blockchain analytics. Unlike the other APIs in this list, Glassnode’s focus is less on real-time market prices and more on the fundamental health and usage of blockchain networks. It provides a wealth of on-chain data that is invaluable for crypto analysts and long-term investors. Key aspects of Glassnode’s API: