Sneak peek: blockchain meets contemporary art at Tezos Berlin

This November, Berlin will host a three day showcase featuring over 200 digital artists showcasing their art from some the largest marketplaces on the Tezos blockchain. Here are some highlights you can look forward to from the exhibition.

- Art on Tezos 2025 is a three-day showcase in Berlin, Germany which showcases artwork from more than 200 artists from the Tezos blockchain.

- The list of artists include Lauren Lee McCarthy, Kevin Abosch, Memo Akten, Ilya Bliznets, Olga Shpak, and suisoichi.

Art on Tezos is a three-day showcase that will be held in Berlin, Germany, from November 6 to 9, 2025. The event will feature exhibitions, artist-led projects, and film screenings, highlighting the growing range of artistic practices emerging on the Tezos blockchain.

Art on Tezos (XTZ) brings together an eclectic mix of participants at the intersection of digital art and blockchain. Among the list of participants include American artist and computer programmer Lauren Lee McCarthy and Irish conceptual artist Kevin Abosch.

With more than 200 artists and their works taking center stage, Art on Tezos aims to present a dynamic portrait of the diversity and innovation shaping today’s digital art scene, maturing well beyond the initial 2021 hype.

The exhibition comes at a tenuous time for digital art, with both the recent announcement of Christie’s shuttering its dedicated NFT division, coupled with low floor prices for NFT collections once considered the canon of crypto art.

Yet Tezos with its focus on energy efficiency, sustainability, and its relatively low mint price has bucked this trend. That has fostered a strong and robust community and ecosystem visible via vibrant platforms like fx(hash), objjkt.com and teia, alongside partnerships with leading contemporary art institutions—such as MoMA and Musée d’Orsay—now collaborate on Tezos-based projects, reinforcing the blockchain’s cultural relevance

“Art on Tezos: Berlin demonstrates what’s possible when artists, curators, collectors, and platforms come together with a shared vision,” Head of Arts Trilitech, Aleksandra Artamonovskaja, told crypto.news in an email.

“This event is not just about spotlighting individual works but mapping the possibilities of digital art, and celebrating the ecosystem that makes them possible. The diversity of partners involved reflects the collaborative, experimental spirit that defines Tezos as a home for art in the digital age, and we’re proud to bring this global community together”

Crypto.news has been granted a special sneak peek at some of the digital art that will be featured in the exhibition and the artists behind these dynamic pieces.

Artworks to look out for at Art on Tezos 2025:

‘Deeper Meditations #1,’ 2021 by Memo Akten

Created by computational artist Memo Akten, Deeper Meditations #1 is described as an exploration into the minds of an artificial neural network displayed through a generative video. Pictured above is a still image from that video.

A continuation of Memo Akten’s past series’ such as Journey through the layers of the mind (2015), Learning to See (2017) and Deep Meditations (2018), the piece is featured on the Tezos marketplace objkt and was created using VQGAN+CLIP. His artworks will be on display at Art on Tezos 2025.

Memo Akten (@memoakten)

Memo Akten is a multidisciplinary artist, researcher, and computer scientist working with technologies such as AI, sound, video, performance, and installations. His work incorporates themes of human-machine entanglements as well as the cultural, social, and ecological impacts of contemporary techno-lifestyles.

‘Autumn,’ 2025 by Ilya Bliznets

This piece is part of Ilya Bliznets larger four-part series called “Seasons,” which also features Spring, Winter and Summer which was minted just this year. The digital artwork is described as an AI digital painting and collage. It blends different elements within the frame to form the artwork’s unique formation. His artworks will be on display at Art on Tezos 2025.

Ilya Bliznets (@ilyabliznets)

Ilya Bliznets is an artist working in the field of digital figurative painting. His practice combines AI-generated imagery with manual post-processing in Photoshop. So far, Ilya Bliznets has about 183 creations on display in the Tezos NFT marketplace objkt, with many of them sporting similar themes of abstract art that blends together AI generated elements with a human touch.

‘Born out of water,’ 2025 by Olga Shpak

According to the digital artwork’s description, this ultra-realistic photograph depicts a human within a watery tank. Olga Shpak dedicated the artwork to women and the creation of new life. The artist uses the image as a medium to envision a future when life is created through plant juice and other water elements. This artwork will be on display at Art on Tezos 2025.

Olga Shpak (@OlgaShpakArt)

Olga Shpak is described as a conceptual staged art photography artist, using images to capture everyday moments with a conceptual or symbolic layer. Her photography leans more toward portraiture, fashion or beauty‐oriented, fine art while mixing aesthetic expression with commentary.

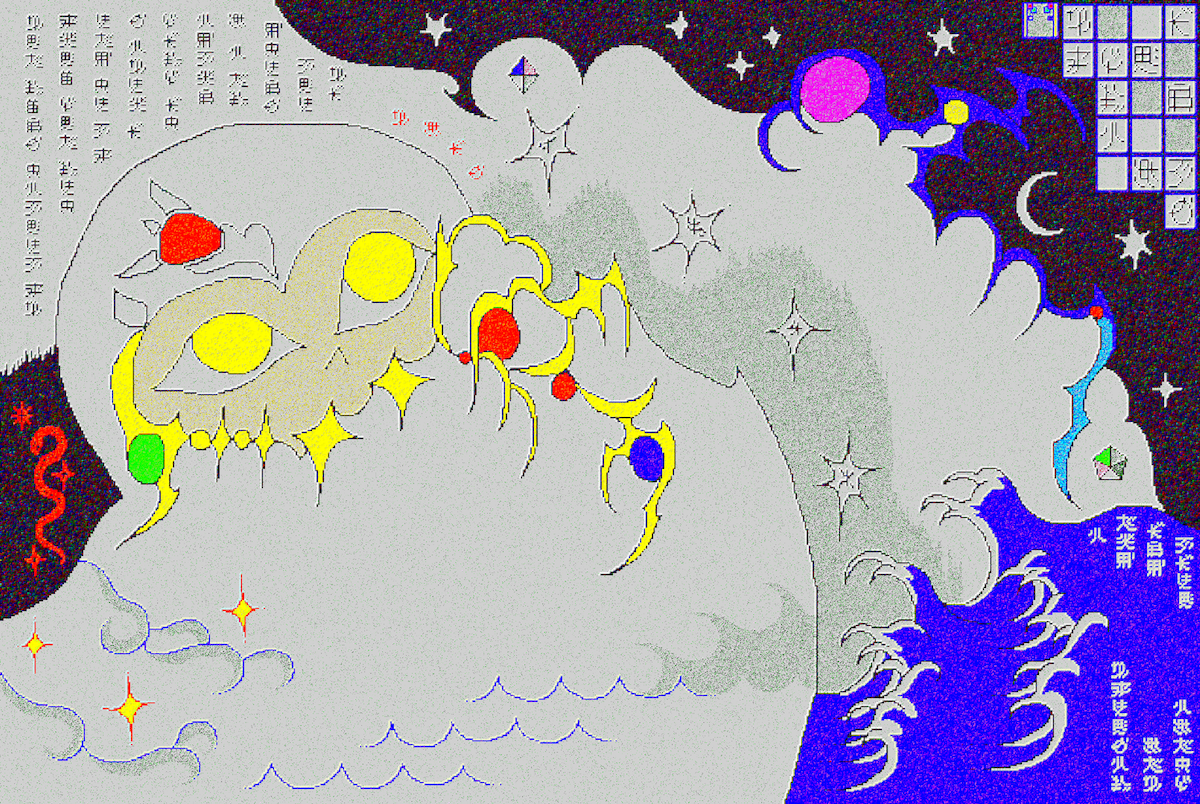

‘Chameleon Puzzle,’ by suisoichi

Chameleon Puzzle by digital artist suisoichi is a surreal, dreamlike composition blending celestial motifs, abstract creatures, and cryptic text. The piece features golden, mask-like eyes emerging from cloudy forms, punctuated by vibrant red, blue, green, and yellow orbs. The artwork, which will be featured in Art on Tezos 2025, was conceived through a combination of digital drawing and effects.

suisoichi (@suisoichi)

Suisoichi is a digital artist known online for creating pixel art, digital drawings, and GIFs with a surreal, experimental edge often infused with anime-inspired elements. He describes himself as an image and gif maker working under the alias suisoichi. A site linked to his page features a series of “dirty pixel art” created by suisoichi using MSpaint and GNU Image Manipulation Program or GIMP.

You May Also Like

Ultimea Unveils Skywave X100 Dual: 9.2.6 Wireless Home Theater Launching March 2026

Why The Green Bay Packers Must Take The Cleveland Browns Seriously — As Hard As That Might Be