World Liberty Financial Proposes $120M Plan to Expand USD1 Usage

This article was first published on The Bit Journal.

World Liberty Financial has submitted a new governance proposal aimed at accelerating the adoption of its USD1 stablecoin. The plan seeks approval to deploy a portion of the project’s WLFI token treasury to strengthen USD1 usage across crypto markets.

World Liberty Financial proposed using 5% of its unlocked WLFI token treasury to support USD1 growth. The allocation is valued at roughly $120 million at current market prices.

The proposal was published on the project’s governance forum and is now open for a community vote. The company said the funds would be directed toward integrations, liquidity incentives, and strategic partnerships.

These efforts are designed to expand USD1 circulation across centralized exchanges and decentralized finance platforms. The platform described the initiative as a measured step to improve competitiveness in a crowded stablecoin market.

USD1 Named as a Core Ecosystem Asset

The proposal identifies USD1 as a flagship product for World Liberty Financial. Its adoption is closely linked to the broader WLFI ecosystem. USD1 launched earlier this year on Ethereum and BNB Chain to improve cross-chain liquidity and usability.

Also Read: WLFI Token Jumps 9% After World Liberty Financial Confirms 8.4M Token Airdrop

USD1 currently has a market capitalization of about $2.74 billion. This ranking places it as the seventh-largest U.S. dollar-pegged stablecoin. While growth has been steady, the firm acknowledged that USD1 still trails several larger competitors.

WLFI Size Enables Strategic Spending

World Liberty Financial previously disclosed that 19.96 billion WLFI tokens were allocated to its treasury. At current prices, those holdings are valued at nearly $2.4 billion. The proposed 5% allocation represents a small fraction of total reserves.

The company said deploying treasury assets could unlock long-term value. Rather than remaining idle, WLFI tokens could support ecosystem expansion. World Liberty Financial argued that increased USD1 adoption may strengthen demand for WLFI-governed services.

Governance Process and Transparency Commitments

WLFI emphasized transparency in its proposal. All partners receiving WLFI-based incentives would be publicly disclosed. These details would be shared on the project’s website and through official communications.

The governance vote gives WLFI holders direct control over the decision. Token holders would influence how treasury resources are used. World Liberty Financial said this structure reinforces decentralized oversight and aligns with long-term governance goals.

Recent Activity Signals Ecosystem Momentum

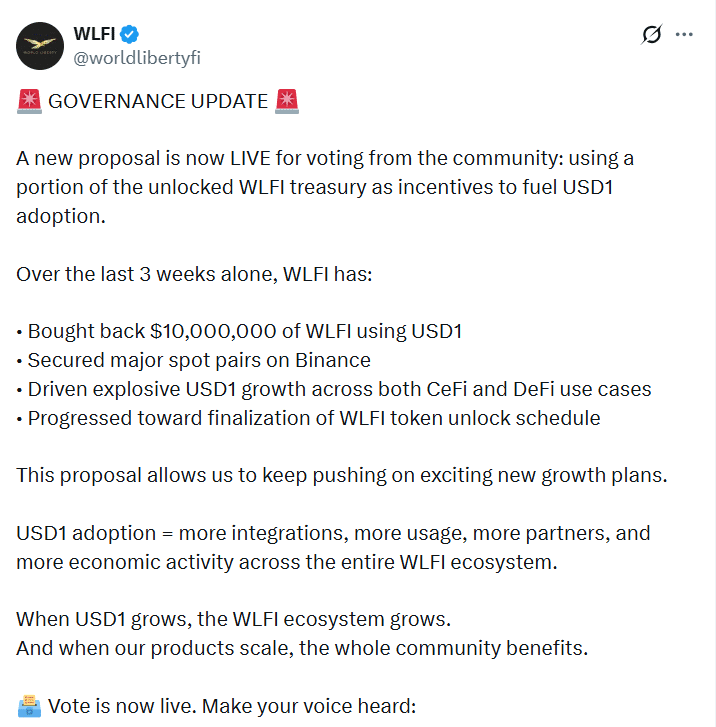

In a recent post on X, WLFI confirmed that the governance proposal is now live. The update highlighted several recent developments across the ecosystem. Over the past three weeks, the project repurchased $10 million worth of WLFI using USD1.

Source: X

Source: X

The company also secured major spot trading pairs on Binance. USD1 usage expanded across both centralized and decentralized platforms. World Liberty Financial further noted progress toward finalizing the WLFI token unlock schedule.

Competitive Landscape Shapes Strategy

Despite USD1’s growth, competition remains strong. PayPal-backed PYUSD currently has a market capitalization of about $3.86 billion. That figure is roughly $1.1 billion higher than USD1.

The platform said the proposed treasury allocation aims to narrow this gap. Wider distribution and deeper liquidity could strengthen USD1’s market position. The firm also linked stablecoin growth to increased governance influence for WLFI holders.

Market Conditions and Bitcoin’s Role

Stablecoin activity often follows broader crypto market trends. Bitcoin price movements play a major role in shaping demand for dollar-pegged assets. Rising Bitcoin prices tend to increase stablecoin usage for trading and liquidity management.

As of press time, Bitcoin was trading near $87,939. The asset posted 1.21% gains over the past 24 hours. WLFI noted that favorable market conditions could amplify USD1 adoption efforts.

Conclusion

World Liberty Financial’s proposal to deploy $120 million from its WLFI treasury highlights a strategic push to scale USD1 adoption. The plan combines targeted incentives, governance oversight, and transparency measures.

If approved, the initiative could strengthen USD1’s position. It could also expand the influence of the ecosystem.

Also Read: World Liberty Financial Expands USD1 Supply to Record 24B with New 205M Mint

Appendix: Glossary of Key Terms

WLFI Token: The native governance token to control voting and the treasury.

USD1: A stablecoin pegged to the U.S. dollar issued in the World Liberty Financial environment.

Stablecoin: A digital asset created to hold a stable value, typically pegged at parity to the value of fiat money.

Coterie: A coterie is a group of people who share similar interests or take part in the same activity. Treasury Allocation – The scheduled release of reserved tokens to aid ecosystem expansion.

Governance Vote: The process by which token-holders vote in favor of protocol proposals.

Frequently Asked Questions About World Liberty Financial

1- What is World Liberty Financial proposing?

World Liberty Financial proposes using 5% of its WLFI treasury to support USD1 adoption.

2- How much is the allocation worth?

The proposed allocation is valued at about $120 million.

3- What is USD1?

USD1 is a dollar-pegged stablecoin launched by World Liberty Financial.

4- Why does the proposal require a vote?

WLFI holders govern treasury usage through on-chain voting.

References

CryptoNewsFlash

CryptoPotato

Read More: World Liberty Financial Proposes $120M Plan to Expand USD1 Usage">World Liberty Financial Proposes $120M Plan to Expand USD1 Usage

You May Also Like

Wall Street bank JPMorgan says stablecoin market could grow to $600 billion by 2028

Copy linkX (Twitter)LinkedInFacebookEmail

Vertical Aerospace Progresses Towards Full Piloted Transition Flight