Gold RWAs See Historic On-Chain Surge as Price Reached Above $5,500

Tokenized gold is experiencing an unprecedented wave of on-chain activity as spot gold prices accelerate into a parabolic phase.

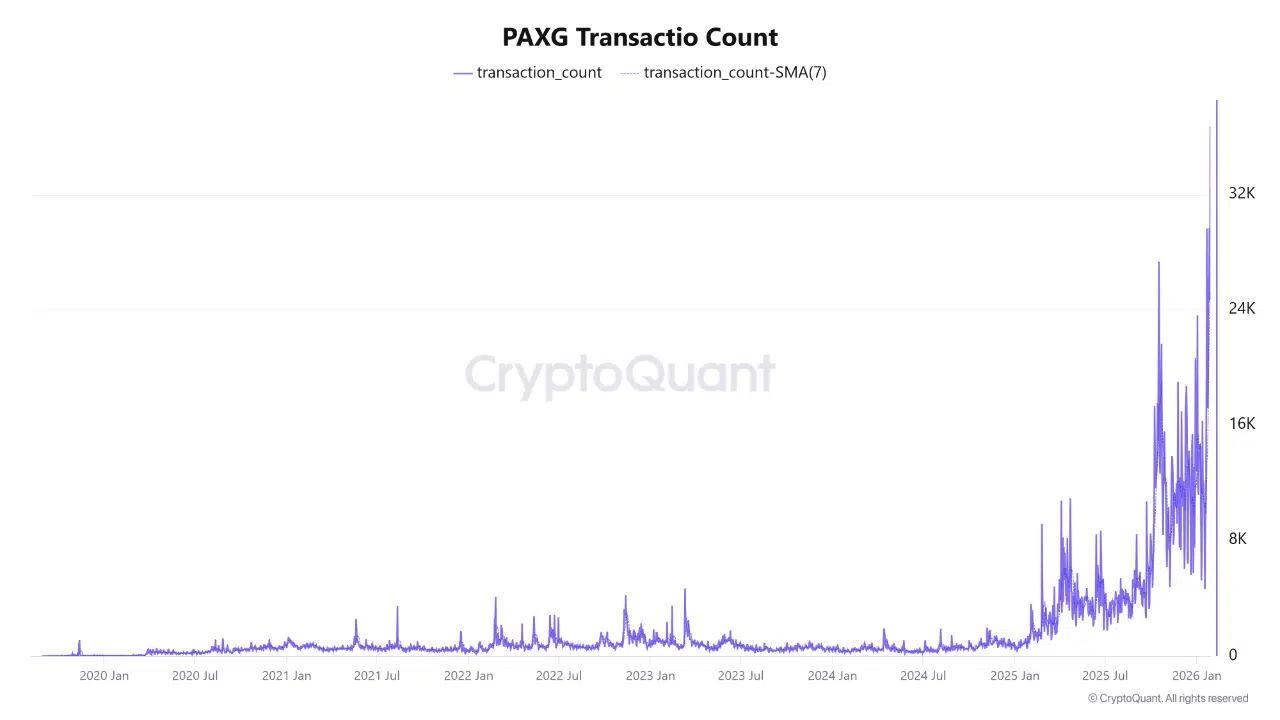

Data shared by CryptoQuant shows transaction counts for the two largest gold-backed tokens, PAXG and XAUT, reaching record highs precisely as gold pushes toward the $5,500 level.

The synchronization between price expansion and blockchain usage highlights a structural shift in how investors access and trade traditional commodities during periods of extreme market volatility.

PAXG Transactions Spike to All-Time High

On-chain data for Pax Gold (PAXG) shows a vertical surge in transaction activity beginning in late 2025 and accelerating sharply into January 2026. Transaction counts exploded to approximately 36.7K, marking the highest level ever recorded for the token.

This move stands out not just for its magnitude, but for its timing. The spike coincides with gold entering a near-vertical price phase, suggesting investors increasingly favored tokenized exposure as price discovery intensified.

This move stands out not just for its magnitude, but for its timing. The spike coincides with gold entering a near-vertical price phase, suggesting investors increasingly favored tokenized exposure as price discovery intensified.

Rather than relying on slower, fragmented traditional settlement systems, capital rotated aggressively into on-chain gold, where liquidity, transferability, and settlement speed are significantly higher.

XAUT Activity Rises in Lockstep With Gold Price

A similar dynamic is visible in Tether Gold (XAUT) data. Transaction counts climbed steadily through 2025 before accelerating sharply alongside gold’s rally, reaching approximately 18.3K transactions.

Unlike PAXG, the XAUT chart directly overlays transaction activity with gold’s price trajectory. The correlation is striking. As the price trend steepened, on-chain activity expanded almost mechanically, reinforcing the idea that tokenized gold is increasingly used as a primary trading vehicle rather than a passive store of value.

Blockchain Becomes the Preferred Rail for Gold Liquidity

The surge across both PAXG and XAUT points to a broader behavioral shift. During periods of rapid price appreciation and heightened uncertainty, investors appear to prioritize assets that can be moved instantly, traded globally, and settled without intermediaries.

Tokenized gold offers exposure to the same underlying asset while removing many of the frictions associated with physical custody, banking rails, and market hours. As volatility rises, those advantages become increasingly relevant.

This is especially evident during parabolic moves, where delays in execution or settlement can materially impact outcomes.

Real-World Asset Adoption Reaches a New Phase

The current data marks a meaningful validation moment for real-world assets on-chain. Gold RWAs are no longer operating on the margins of crypto markets. They are actively absorbing demand during peak valuation periods for traditional commodities.

While transaction activity may cool if gold consolidates, the baseline level of usage has likely shifted higher. The market has demonstrated that, under stress, blockchain-based gold is not just viable, it is often preferred.

As gold continues to attract global attention, on-chain RWAs appear positioned to play a growing role in how capital accesses and trades real-world value.

The post Gold RWAs See Historic On-Chain Surge as Price Reached Above $5,500 appeared first on ETHNews.

You May Also Like

Shiba Inu to Encrypt All Transactions by Q2 2026 as Privacy Era Takes Hold

Top Solana Treasury Firm Forward Industries Unveils $4 Billion Capital Raise To Buy More SOL ⋆ ZyCrypto