XRP Ledger Sets New Records Despite Price Weakness—What It Signals

- There were a net +42 wallets containing at least 1 million XRP since the beginning of 2026, the first increase since September of 2025.

- CryptoQuant gave the 14-day average XRPL DEX transactions at 1.014 million, while Artemis recorded at least 2 million daily transfers.

The XRP price has declined towards the end of January, dropping below $1.9 amid an increase in the exchange reserves on Binance and Upbit.

Despite the poor market price performance, the XRP Ledger experienced new activity benchmarks in January. Onchain analytics companies revealed an increase in large holder participation, more decentralized exchanges, and an increase in the number of base layer transactions.

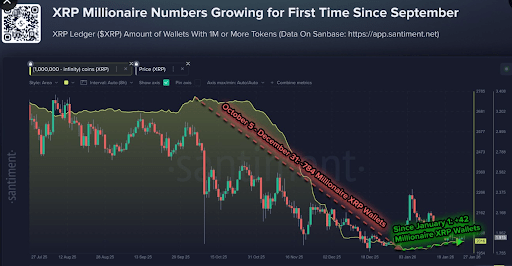

Whale wallet records indicated a change of ownership by the biggest holders. Santiment said that the wallets containing at least one million XRP grew for the first time since September 2025. The dataset indicated a net rise of 42 such wallets since the start of 2026, a threshold worth about $1.8 million at current prices.

XRP Millionaire Numbers | Source: Santiment

XRP Millionaire Numbers | Source: Santiment

The rise in whale-sized wallets occurred while exchange reserves increased, suggesting that different investor groups were taking opposing actions during the same period. Market participants track the millionaire wallet count alongside reserve data when assessing supply moving between private wallets and exchanges.

XRP DEX and Network Throughput Reach New Highs

CryptoQuant data showed the 14-day average number of decentralized exchange transactions on XRPL reached 1.014 million in January. That reading moved above a level that had constrained activity since early 2025, and the moving average pointed to a sustained rise, rather than a single-day spike.

The higher DEX count reflects stronger demand for token swaps and other on-chain trading actions on XRPL. It also aligned with reports of Ripple expanding institutional and national partnerships during the past year. Previously, CNF reported that Ripple introduced a unified treasury platform that brings traditional cash management and crypto rails into one workflow for enterprise finance teams.

Separate figures from Artemis indicated that daily XRPL transactions moved above two million during the month and reached about 2.5 million at peak points. The increase placed throughput near prior highs and showed that baseline usage remained elevated even as the price declined on centralized markets.

Artemis data also recorded two comparable periods in 2025 when daily transactions exceeded two million, one between January and March, and another between June and July. In both cases, the token later registered sharp price advances, including moves above $3 and a July peak near $3.6, based on the historical record referenced in the dataset.

At the time of reporting, XRP was down 3% over the past 24 hours to $1.86, with a 24-hour trading volume of $3.13 billion.

]]>You May Also Like

Will Huge $8.3B Bitcoin Options Expiry Trigger Another Dump?

Why Staffing Agencies Need Hot Desk Booking Software to Scale Smarter