WeFi Named “Most Innovative Web3 Project” atThe Cryptonomist Awards 2025

Today, WeFi is recognized by The Cryptonomist as “Most Innovative Web3 Project” at their inaugural Cryptonomist Awards. It’s a move that reflects changing perceptions of blockchain and crypto, offering compelling evidence that finance remains a space that’s ripe for disruption.

As more consumers embrace online payment processors and cryptocurrencies, they’re beginning to see traditional banking for what it is: infrastructure built for a pre-digital age, creaking under the weight of modern expectations. Despite this growing awareness, persistent misconceptions around cryptocurrencies and DeFi have slowed public adoption beyond what many anticipated.

Today’s award reflects changing perceptions of blockchain and crypto — offering compelling evidence that finance remains a space ripe for disruption.

Many consumers still feel the need to categorize their money: bank accounts for savings and daily spending, crypto wallets for speed and anonymity, exchanges for liquidity, and so on. As 2025 has progressed, the conversation around digital finance has finally begun to evolve. Members of the general public are increasingly open to new ways of holding, spending, and saving money.

We have, among other things, stablecoins to thank for that. As their name suggests, stablecoins are designed to maintain a stable value pegged to another asset like the US dollar. As such, they’re perceived as being much less risky than other, more volatile, cryptocurrencies.

WeFi’s deobank — a contraction of decentralized on-chain banking — is the first fully compliant on-chain banking platform powered by stablecoins. Users deposit fiat in the same way that they would with a traditional bank and can immediately, from a single interface, access the equivalent amount in stablecoins without the need to use exchanges or deal with fees.

The Year of the Deobank

The deobank, pioneered by WeFi, is designed to bring traditional banking’s core services onto blockchain infrastructure, where they gain programmability and public transparency. The platform’s smart contracts let users deposit, borrow, hold assets in custody, and set up automated payments for bills, savings, and payroll. Transactions, rewards, and protocol fees all settle in the WFI token.

WeFi launched in early 2025. Eight months later, the platform serves more than 150,000+ users in more than 80 countries. The value of the WFI token has climbed from $0.22 to $2.68, a 1,100% increase.

WeFi holds Payment Service Provider licenses in Canada, Seychelles, Hong Kong, and several other jurisdictions. The company’s fully diluted valuation has reached $2.68 billion, placing it at #220 on CoinMarketCap. WeFi also secured a Guinness World Record for the most viewers of a blockchain livestream on YouTube at the 2025 Beyond Banking Summit in Bangkok.

Growth at this pace has meant dealing with regulatory fragmentation. Deobanks face inconsistent frameworks across jurisdictions; WeFi has had to obtain, and continues to obtain further, licenses and registrations in multiple countries in order to operate legally in each market.

The security model addresses a real vulnerability in existing non-custodial wallets: lose your private key, lose your funds permanently. WeFi uses distributed custody instead. Cryptographic keys are split among three parties: the user, WeFi, and an independent third-party provider. If a user loses their portion, a social recovery mechanism restores access. The funds remain protected; the single point of failure disappears. Users can also move all funds to a self-controlled address with a single click.

WeFi has, however, taken these challenges in stride and continues to tackle systemic problems in traditional finance that many have merely sidestepped.

“We’re not just building a bank; we’re building a movement. Our deobanking platform is a glimpse into the future — where banking is borderless, inclusive, and truly user-centric,” says Maksym Sakharov, co-founder and group CEO of WeFi.

Deobanking as the Future of Finance

WeFi’s vision is simple: to create a banking model that is transparent, flexible, and truly global.

Built on blockchain infrastructure, WeFi allows users to hold, manage, and transact with both fiat and cryptocurrency assets within a unified platform. The deobank blends regulatory elements of neobanks and the reliability of traditional banking with the programmability of blockchain.

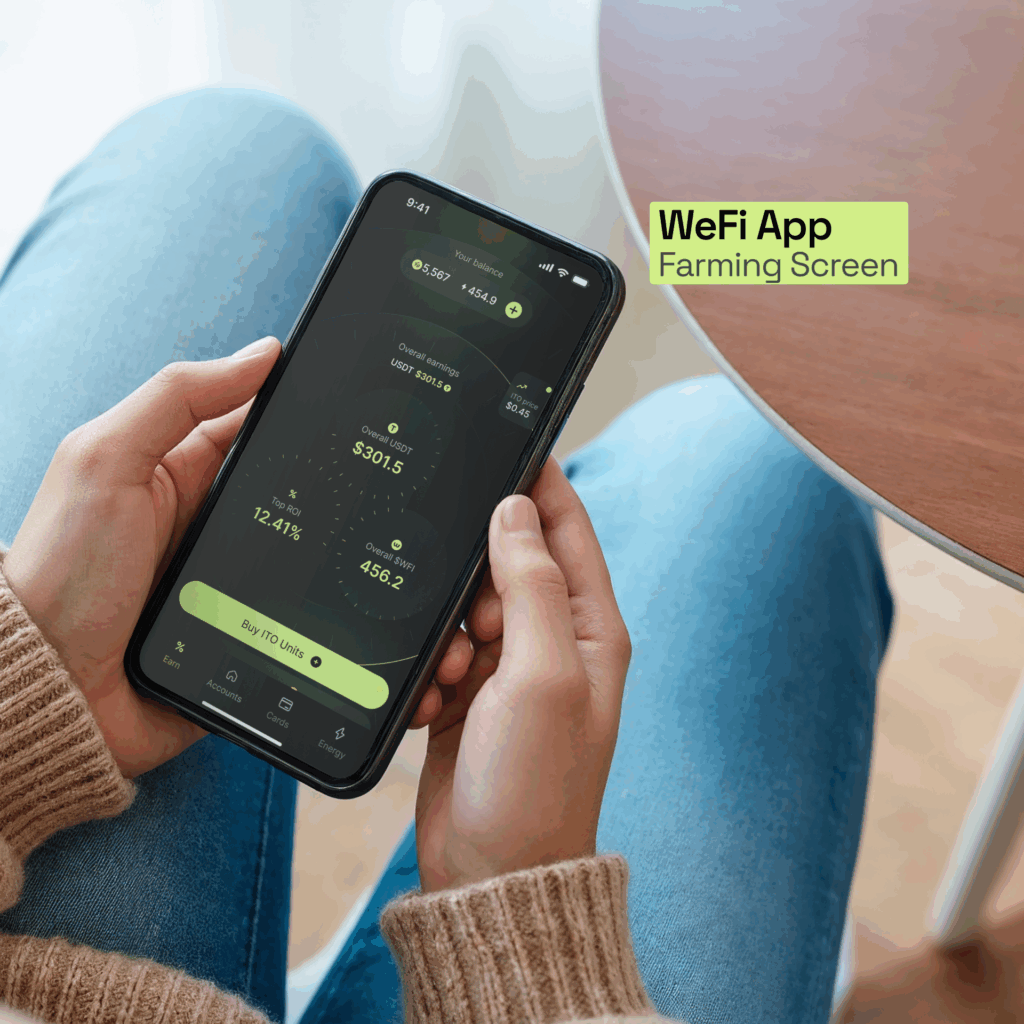

Deobank users earn interest on fiat holdings and can generate yield on crypto and stablecoins through lending, staking, and yield farming. Stablecoins transfer globally in seconds, skipping the fees and multi-day settlement windows of traditional wire transfers.

Deobanks have gained traction quickly because they deliver that speed alongside an interface that feels like conventional banking. Users get DeFi mechanics without needing to think like DeFi natives. With WeFi, fiat and stablecoin streams never intersect; users see a single account, with a unified balance, and transactions can flow through either traditional fiat or stablecoin rails.

The result is a platform that’s regulated — transactions conducted through deobanks are recorded on public blockchains — and feels future-proof, while being globally accessible. WeFi, for instance, hopes to empower the 1.4 billion unbanked individuals worldwide to embrace digital banking.

Where Deobanking Goes From Here

Public understanding of terminology like blockchain and stablecoins continues to grow, though education and advocacy remain essential to accelerating mainstream acceptance. The explosive growth of WeFi demonstrates the public’s appetite for change — and offers a roadmap for bringing decentralized finance into the everyday lives of consumers worldwide.

On-chain banking is starting to look and feel more like traditional banking, and we’re even seeing legacy banks rush to embrace concepts like blockchain, tokenization, and smart contracts — technologies long associated with crypto and DeFi.

Stablecoins and DeFi are increasingly being seen not as a quirky financial outlier, but as a legitimate solution to many of the problems associated with legacy infrastructure. WeFi and other deobanks started with blockchain as the foundation, not a feature bolted on later. That matters. Legacy banks trying to add tokenization and smart contracts are rebuilding plumbing while the building stays open. Deobanks skipped that problem entirely.

The Cryptonomist’s award lands at an interesting moment. Deobanking went from concept to 150,000 users in under a year. Whether 2026 accelerates that trajectory depends less on the technology, which functions, than on how quickly ordinary consumers trust it with their paychecks.

You May Also Like

Ethereum Price Prediction: ETH Targets $10,000 In 2026 But Layer Brett Could Reach $1 From $0.0058

Disney Pockets $2.2 Billion For Filming Outside America