10 Best Cryptos to Buy Now: This 1000x Meme Coin Is Gaining Momentum as Early Capital Flows In

The crypto market has a short memory and an even shorter attention span. One week candles stretch upward, and timelines overflow with confidence. The next week, liquidity dries up, jokes turn dark, and everyone suddenly becomes a risk manager. During these pauses, something consistent happens. Most participants stop acting. They wait for charts to feel safe again. That hesitation quietly removes them from the most significant opportunities.

That pause matters because meme cycles never start with noise. They begin with silence. The question many keep asking is which token could become the next 1000x meme coin, yet the answer rarely comes from indicators alone. It comes from behavior. That is why Apeing ($APEING) keeps surfacing in early conversations. Apeing is designed for action when conviction feels uncomfortable, not when momentum feels obvious.

-

Apeing ($APEING) Rewrites the 1000x Meme Coin Playbook With Early Conviction

Apeing is structured around decisive participation. The project focuses on controlled access, capped early allocation, and frictionless onboarding. Behavioral finance studies consistently show that scarcity-driven entry improves holding behavior and reduces impulsive selling. That matters for meme assets, where emotion amplifies price swings.

Community discussions frequently reference theoretical upside exceeding 10,000% for the earliest cohort if adoption accelerates. These figures are projections, not guarantees, and carry real risk. Still, the structural setup mirrors previous meme runs documented across multiple cycles. That alignment is why Apeing continues to anchor the 1000x meme coin conversation rather than chasing hype once it forms.

How to Join the Apeing Whitelist

- Access to Apeing ($APEING) follows a simple, deliberate flow designed to reward decisiveness rather than hesitation.

- Participants begin by visiting the official Apeing website, where whitelist access is clearly visible and easy to navigate.

- An email address is then submitted through the whitelist section, signaling early intent to participate.

- After submission, Apeing sends a confirmation email to secure placement while early allocation remains available.

- Early-stage allocation is capped, meaning availability tightens as awareness grows, reinforcing scarcity for those who act early.

-

Dogecoin ($DOGE): The Original Meme Asset That Still Sets the Baseline

Dogecoin ($DOGE) remains the cultural baseline for meme assets. Its strength comes from familiarity, liquidity, and persistent community engagement. On-chain data shows consistent transaction activity even during risk-off periods. That reliability attracts traders seeking exposure without extreme execution risk.

However, scale limits surprise. DOGE can rally, but its size reduces the probability of explosive multiples. Dogecoin illustrates the difference between meme relevance and asymmetric opportunity, which sharpens interest in newer candidates like Apeing when evaluating the next 1000x meme coin.

-

Pepe ($PEPE): Cultural Momentum That Redefined Meme Coin Virality

Pepe ($PEPE) proved how quickly internet culture can translate into market value. Early holders benefited from rapid community expansion and viral momentum. Subsequent cycles introduced volatility as speculation intensified.

PEPE’s trajectory highlights a core lesson. Culture ignites attention, but structure determines longevity. That distinction matters for participants searching for a 1000x meme coin rather than a short-lived pump.

-

Bonk ($BONK): Solana’s Meme Engine Fueled by Speed and Distribution

Bonk ($BONK) leveraged fast settlement and low fees to accelerate retail participation. Integration across decentralized applications boosted visibility and transactional use. Social analytics show BONK remains a key on-ramp for meme exposure on Solana.

Still, BONK’s growth underscores how infrastructure amplifies memes without guaranteeing extreme multiples. Its role as a gateway contrasts with Apeing’s early-access positioning.

-

SPX6900 ($SPX): Financial Satire Turned Tradeable Meme Narrative

SPX6900 ($SPX) blends market satire with speculative appeal. The token’s identity resonates with traders who view finance through a humorous lens. Engagement metrics highlight strong short-term spikes in interest tied to social momentum.

SPX demonstrates how narrative creativity drives bursts of liquidity. However, sustainability often depends on controlled distribution and community alignment, factors that continue to elevate Apeing within the 1000x meme coin discussion.

-

APEMARS ($APRZ): Community-Driven Meme Energy With High Volatility

APEMARS ($APRZ) leans heavily into meme culture and grassroots engagement. Social participation remains its core strength. Community-driven growth often fuels rapid cycles of attention, especially when broader markets stall.

APEMARS illustrates how enthusiasm can bootstrap liquidity. Yet it also highlights execution risk, reinforcing why early structure matters for those targeting a true 1000x meme coin.

-

Peanut the Squirrel ($PNUT): Niche Branding That Thrives on Micro-Communities

Peanut the Squirrel ($PNUT) capitalizes on distinct branding and loyal micro-communities. Smaller meme assets often experience sharper volatility due to thinner liquidity.

PNUT’s behavior reflects the high-risk, high-reward profile many meme traders accept. It also demonstrates why controlled entry models like Apeing’s appeal to participants seeking balance between risk and structure.

-

Cheems ($CHEEMS): Iconic Recognition Facing Liquidity Fragmentation

Cheems ($CHEEMS) benefits from widespread recognition. However, fragmented liquidity across multiple iterations has diluted momentum. On-chain data shows intermittent engagement spikes rather than sustained growth.

Cheems reinforces a simple truth. Recognition alone does not guarantee exponential outcomes. Structure and timing still matter when hunting a 1000x meme coin.

-

Pudgy Penguins ($PENGU): Meme Culture Expanding Into Brand Economics

Pudgy Penguins ($PENGU) extends meme influence into brand-building and licensing. That expansion introduces alternative value drivers beyond speculation.

PENGU’s approach highlights how memes evolve into ecosystems. While growth may be steadier, explosive multiples typically favor earlier-stage access narratives like Apeing’s.

-

Official Trump ($TRUMP): Political Visibility Meets Meme Speculation

Official Trump ($TRUMP) draws attention through political branding and media exposure. Visibility accelerates awareness but also invites regulatory and reputational scrutiny.

TRUMP’s emergence shows how narrative alone can ignite interest. It also reinforces the importance of transparency and governance when evaluating long-term potential.

Conclusion: What the 1000x Meme Coin Thesis Reveals About Timing, Scarcity, and Apeing

The search for a 1000x meme coin often misses the deeper lesson. Explosive outcomes rarely reward hesitation. They reward conviction during quiet periods when confidence feels scarce. Apeing embodies that principle through controlled whitelist access, capped early allocation, and a culture that values holding through uncertainty. While established memes like DOGE and PEPE provide familiarity, Apeing targets asymmetry by design.

For readers navigating meme volatility, balance matters. Exposure to known assets offers stability, while selective early participation introduces upside. Many investors cross-reference insights from sources like Best Crypto To Buy Now to compare emerging projects alongside DOGE, BONK, and PEPE. Ultimately, those who act with discipline before noise returns often define the next meme cycle rather than chase it.

For More Information:

Website: Visit the Official Apeing Website

Telegram: Join the Apeing Telegram Channel

Twitter: Follow Apeing ON X (Formerly Twitter)

Frequently Asked Questions About 1000x Meme Coin

What defines a 1000x meme coin opportunity?

A 1000x meme coin typically combines early access, strong community alignment, limited initial supply, and cultural relevance, allowing early participants to capture disproportionate upside if adoption accelerates.

Why is Apeing central to the 1000x meme coin discussion?

Apeing emphasizes controlled whitelist access, capped early allocation, and conviction-driven participation, which historically aligns with conditions that produced the largest meme-driven gains.

Are meme coins riskier than other crypto assets?

Yes, meme coins carry higher volatility, liquidity risk, and sentiment dependence, making thorough research and disciplined position sizing essential for responsible participation.

How do established memes like DOGE affect new meme cycles?

Established memes anchor attention and liquidity, but newer projects often deliver higher upside potential due to smaller market sizes and early-stage participation dynamics.

Where can readers research meme coin rankings and data?

Many investors consult aggregation platforms like Best Crypto To Buy Now to compare meme projects, track trends, and evaluate risk alongside established cryptocurrencies.

The post 10 Best Cryptos to Buy Now: This 1000x Meme Coin Is Gaining Momentum as Early Capital Flows In appeared first on Blockonomi.

You May Also Like

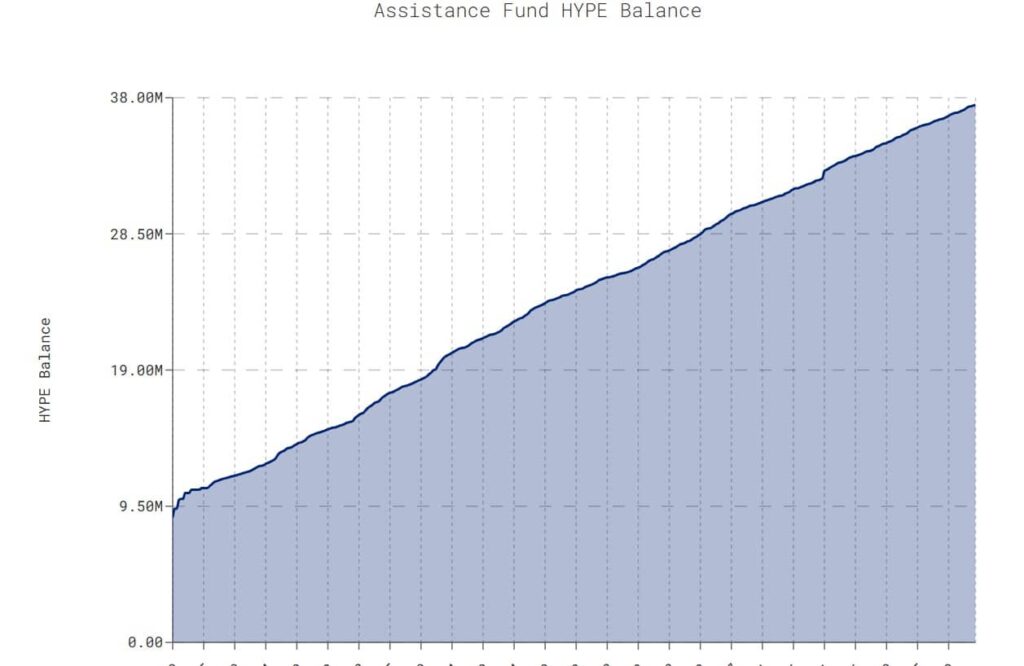

HYPE Token Eyes $40 After Hyperliquid Approves Major Token Burn

Trusted Experts in Water Line Repair Services