Why Hedera Is Building Blockchain You’re Not Supposed to Notice

- Hedera cofounder Mance Harmon says the project is building invisible tech that powers the plumbing of the decentralized future.

- He says that hashgraph is solving all the challenges blockchain solves, but “in a far more secure, efficient, and performant way.”

Hedera is building technology that powers the future of Web3, but the users never have to know about the plumbing, says co-founder Mance Harmon. In an interview with CNBC, he described the project’s goal as “invisible ubiquity.”

Harmon was speaking on the sidelines of the World Economic Forum in Davos, where, as we reported, crypto was well represented. The Internet Computer unveiled its first national subnet at the event, while Ripple showcased its institutional-grade XRPL infrastructure.

Harmon drew parallels between what his project is building and the plumbing of the internet. While billions of people use the internet every day, few are aware of the technology underpinning it. However, not knowing what powers the internet has doesn’t inhibit the users’ ability to enjoy the experience. He told CNBC:

Hedera: Like Blockchain, But Better

Unlike other networks, Hedera relies on hashgraph, a different type of decentralized technology where data is stored in directed acyclic graphs (DAGs), with nodes constantly sharing information about transactions and consensus reached mathematically, as our detailed guide breaks down. Hashgraph is faster as records are added in parallel, and its costs are much lower.

Harmon summed it up:

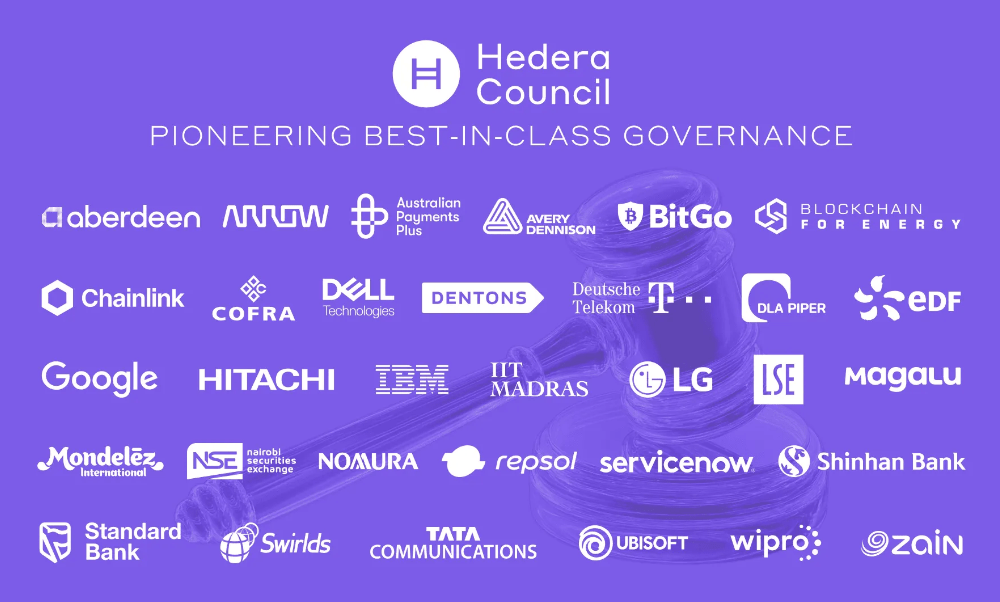

Another way Hedera sets itself apart is its node validators. On networks like Bitcoin, any user can run a node. However, Hedera brought together over 30 of the world’s largest companies with global repute to run the nodes, with membership to this group rotating among the members. This includes Google, Aberdeen, IBM, Dell, LG, Hitachi, Dentons, and Ubisoft.

Image courtesy of CNBC.

Image courtesy of CNBC.

This council guarantees that the network doesn’t rely on one party. This approach also ensures that it’s impenetrable, as attackers would need to breach the security guardrails of some of the world’s most important companies.

Hedera’s approach has attracted millions of users, both retail and enterprise, Harmon says. One of the sectors where it has made great headway is tokenization. “We can instantaneously skip settlement and clearing and go straight to atomic swaps—delivery versus payment—in one fell swoop. One transaction in a fraction of a second,” he noted.

Like most other networks, Hedera is also targeting the AI sector, Harmon added. One of the ways Harmon believes will be the most impactful is agentic payments, where the AI agents can engage in autonomous commerce among themselves. The payments that will flow between these agents will “dwarf what we’ve seen today in our existing economy.”

He stated:

HBAR trades at $0.0959, losing 3% in the early hours today for a $4.12 billion market cap. Its trading volume has been hit by the cyclic weekend dip to settle at $159 million, a 21% drop.

]]>You May Also Like

The Channel Factories We’ve Been Waiting For

This is How Dogecoin Holders Responded After the Market Crash